What Happens if You Don’t Update Your SR22 Insurance

In the world of automobile ownership, there are a lot of complex things for you to deal with. One of them just so happens to be insurance. Insurance is a necessity in that it allows you to pay for any damages that may occur to you or your car. Not having car insurance is a crime and can lead to jail time if continually ignored. In some special cases, you may be required to take out additional insurance due to your actions.

In those cases, it can be hard to know exactly what to do to prevent anything else from causing you to lose your license. Understanding how SR22 insurance applies in these scenarios and knowing what happens when you do not renew this type of insurance is crucial. Read on to find out more about what happens if you don’t update your SR22 insurance.

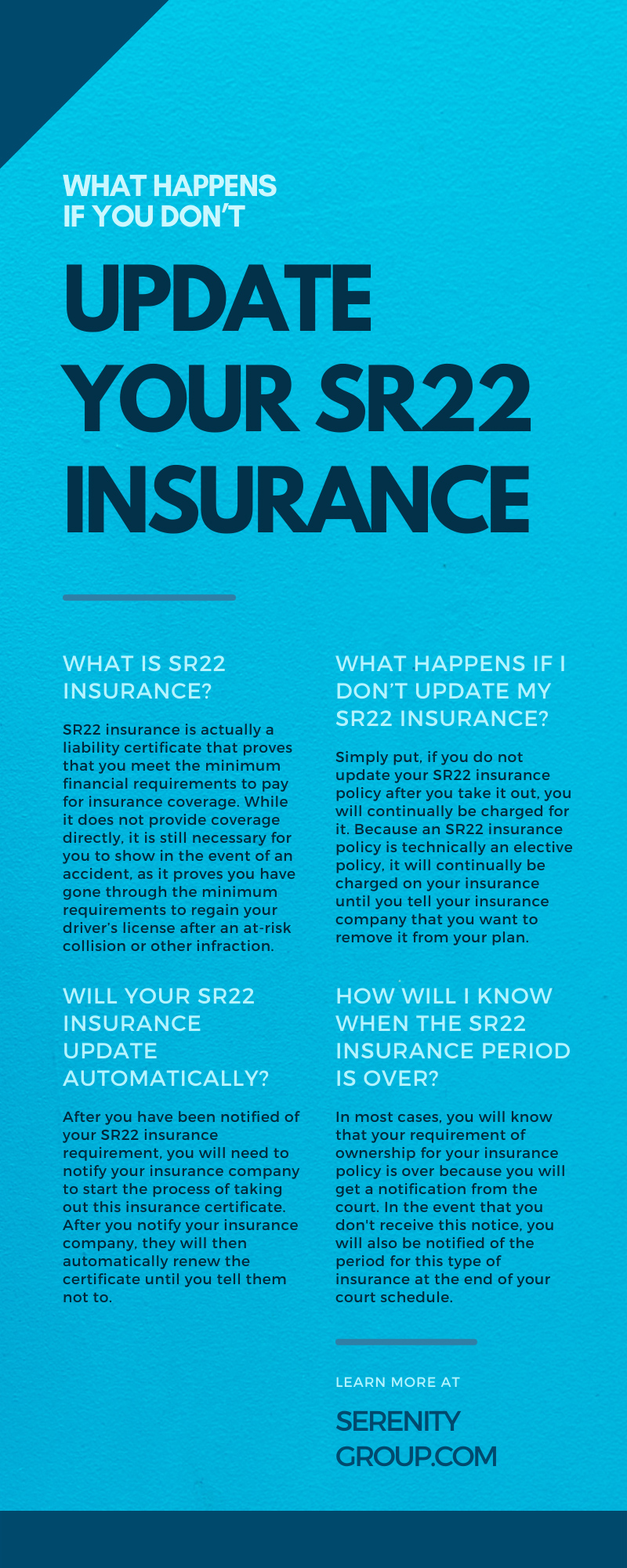

What Is SR22 Insurance?

SR22 insurance is actually a liability certificate that proves that you meet the minimum financial requirements to pay for insurance coverage. While it does not provide coverage directly, it is still necessary for you to show in the event of an accident, as it proves you have gone through the minimum requirements to regain your driver’s license after an at-risk collision or other infraction.

It is important to note that while the causes behind needing SR22 insurance will indeed raise your insurance rates, taking out an SR22 insurance policy will in not raise your rates. However, a side benefit of owning SR22 insurance is that it proves you have followed the minimum requirements of the law whenever you do go to court to try and regain your license. As such, this type of insurance should not be taken lightly, as it can greatly improve your chances of regaining your license in the future. Besides this, it shows the court that you have taken all the necessary steps to regain your license and rid yourself of the need for an expensive SR22 insurance policy that will not cancel on its own.

When Do You Need SR22 Insurance?

Typically, you’ll need SR22 insurance if you have committed certain driving infractions. In most cases, these infractions are related to driving while under the influence of alcohol or drugs. When you incur enough of these charges to have your license taken away, you will be required to take out SR22 insurance. Also known as high-risk driver’s insurance, SR22 insurance proves that you can pay the minimum insurance fees necessary. In most cases, this will be court-ordered, and it will be explicitly stated that you must have this type of insurance before you can regain the privilege of driving. However, this is not to say that you will need this insurance certificate forever; the following sections of this article will help you understand instances when it may no longer be necessary to hold this type of insurance policy.

Will Your SR22 Insurance Update Automatically?

After you have been notified of your SR22 insurance requirement, you will need to notify your insurance company to start the process of taking out this insurance certificate. After you notify your insurance company, they will then automatically renew the certificate until you tell them not to. In most cases, the courts and the insurance companies will never communicate directly, which means that you will have to be the middleman during every part of the process.

While this may be good for long-term insurance purposes, it is important to note that your SR22 insurance requirement will not last forever. As such, make it your top priority to reach out to your insurance as soon as you no longer need this insurance. It is an expensive insurance policy that can hike up your rates, so do not put off canceling it when you are finally able to do so.

Will I Need To Use a Different Insurance Company for an SR22 Insurance Quote?

In most cases, every insurance company will offer these types of insurance policies in states where it is applicable. All you need to do is reach out to your insurance provider and ask them about their high-risk insurance policy rates; they will be sure to help you out. Just be sure to ask whether they will cancel your insurance policy for you or if you will have to do it yourself. If you don’t find out and the policy renews automatically, you will be charged until you request them to stop the service. If you do not have an insurance provider and are looking for one that provides SR22 insurance coverage, reach out to Serenity Group. We are dedicated to providing the best rates to ensure that you get back on the road with as little cost to you as possible.

What Happens If I Don’t Update My SR22 Insurance?

Simply put, if you do not update your SR22 insurance policy after you take it out, you will continually be charged for it. Because an SR22 insurance policy is technically an elective policy, it will continually be charged on your insurance until you tell your insurance company that you want to remove it from your plan. While this may be a good thing in that you don’t have to continually update it, it may be bad if you forget to cancel it and continue to be charged even when you no longer need it. Because of this, it is important for you to remember to cancel your SR22 insurance policy in a timely fashion once it is no longer of use to you.

How Will I Know When the SR22 Insurance Period Is Over?

In most cases, you will know that your requirement of ownership for your insurance policy is over because you will get a notification from the court. In the event that you don’t receive this notice, you will also be notified of the period for this type of insurance at the end of your court schedule. As such, it is important to note these important dates to ensure you do not miss out on your cancellation date and risk being charged for an extra period.

We hope that this guide has helped clarify what happens if you do not update your SR22 insurance policy. If you’re looking to get access to cheap SR22 insurance online, be sure to reach out to Serenity Group today. We are dedicated to bringing the best service to you at the lowest cost possible.

Recent Comments