How a DUI on Your Record Can Affect Your Loans

Driving under the influence (DUI) is a serious offense that can have long-lasting consequences on your personal and professional lives. In addition to possible jail time, fines, and restrictions on your driver’s license, having a DUI charge on your record can also affect your ability to secure loans in the future.

Because loans are crucial parts of many people’s financial stability, it’s important to understand how a DUI on your record can affect your loan options and what steps you can take to mitigate the effects.

What Is a Driving Under the Influence Charge?

A driving under the influence charge, commonly known as a DUI, is a criminal charge given to an individual who is caught operating a vehicle while under the influence of alcohol or drugs. The legal limit for blood alcohol concentration (BAC) varies from state to state, but generally, it is 0.08 percent. If you are caught driving with a BAC above this limit, you can be charged with a DUI.

The consequences of a DUI charge are severe. They can include hefty fines, suspension of your driver’s license, mandatory completion of a drug or alcohol education program, and, in some cases, jail time. A DUI charge also goes on your criminal record, which can have far-reaching implications.

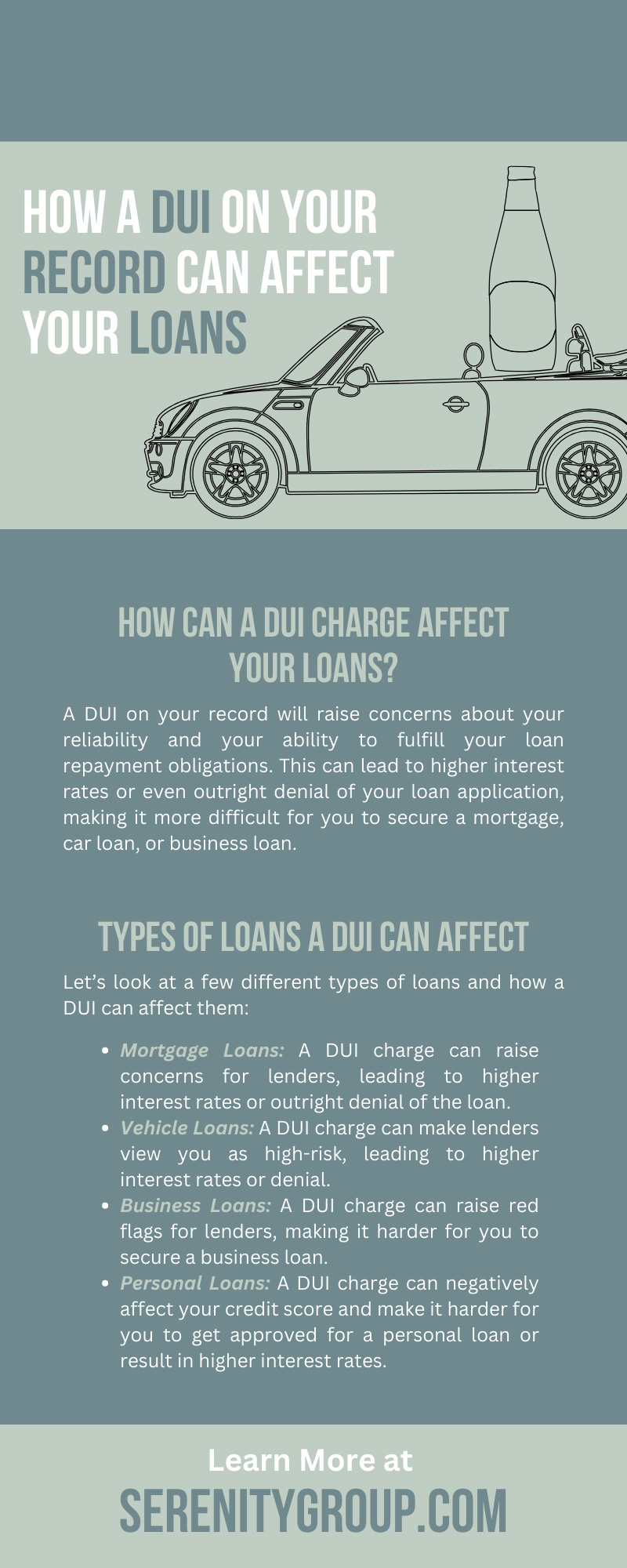

How Can a DUI Charge Affect Your Loans?

Lenders consider several factors when deciding whether to approve a loan application. These include your credit score, income, employment history, and any red flags on your background check, such as a criminal record. A DUI charge, being a criminal offense, will appear on your background check.

A DUI on your record will raise concerns about your reliability and your ability to fulfill your loan repayment obligations. This can lead to higher interest rates or even outright denial of your loan application, making it more difficult for you to secure a mortgage, car loan, or business loan.

A DUI charge can also affect your credit score. If you are unable to promptly pay the fines associated with the charge, the late payments could negatively affect your credit score. A lower credit score can make it harder for you to get approved for loans in the future.

Types of Loans a DUI Can Affect

How does a DUI on your record affect your loan options? Let’s look at a few different types of loans and how a DUI can affect them:

Mortgage Loans

A mortgage loan is a loan someone takes out to purchase a home. Lenders heavily rely on one’s credit score and financial history when deciding whether to approve a mortgage loan application. A DUI charge can raise concerns for lenders, leading to higher interest rates or outright denial of the loan.

Vehicle Loans

If you need a new vehicle but cannot afford to pay up front, you may apply for a loan. Lenders will consider factors such as your income, credit score, and employment history when deciding whether to approve your application. A DUI charge can make lenders view you as high-risk, leading to higher interest rates or denial.

Business Loans

If you’re looking to start or expand a business, you may need to take out a business loan. Lenders will consider your credit score, income, and business plan when evaluating your application. A DUI charge can raise red flags for lenders, making it harder for you to secure a business loan.

Personal Loans

Personal loans are unsecured loans used for various purposes, such as debt consolidation, home improvements, or unexpected expenses. Lenders will consider your credit score and income to determine your eligibility for a personal loan. A DUI charge can negatively affect your credit score and make it harder for you to get approved for a personal loan or result in higher interest rates.

As you can see, a DUI charge on your record can affect various types of loans and make it harder for you to secure the financial assistance you need. This can have long-term consequences on your financial stability and overall well-being.

How To Improve Your Chances of Getting a Loan With a DUI Charge

A DUI charge can make it harder for you to secure loans, but there are steps you can take to improve your chances:

- Work on improving your credit score by making timely payments and keeping a low credit utilization ratio. A good credit score can offset the negative effects of a DUI charge.

- Be prepared to explain the circumstances surrounding your DUI charge to potential lenders, such as seeking treatment for alcohol or drug abuse and taking steps to prevent it from happening again.

- Consider getting a cosigner, such as a family member or friend with a good credit history, to vouch for your loan repayment ability.

- Be honest and up front about your DUI charge when applying for loans. Lying about it can result in more severe consequences later.

With patience and responsible financial habits, and by taking the necessary steps to mitigate the effects of a DUI on your record, you can still work toward achieving your financial goals.

Does a DUI Charge Stay on Your Record Forever?

In most states, a DUI charge will stay on your criminal record forever. However, you may be eligible for expungement, which is the process of sealing or destroying criminal records. Expungement laws vary from state to state and depend on factors such as the severity of the charge and whether it was your first offense. Consult with a lawyer to see if expungement is an option for you.

A DUI charge can have lasting consequences and affect your ability to secure loans. But with the right steps, you can improve your chances and move forward from this mistake. If you have a DUI charge and are struggling with insurance, Serenity Group provides SR-22 insurance quotes in Colorado. SR-22 insurance is often required for individuals who have DUIs on their record, and Serenity Group can help you find the best rates and coverage for your needs. Contact us today to learn more.

Recent Comments