How Cold Weather Can Affect Your Car Insurance

Car insurance is crucial, both for maintaining the legal ability to drive and for your own protection. However, a number of factors can make insurance expensive. That’s why understanding what affects your insurance premium can be an excellent financial goal, as you can try to save more money over time. In this article, we’ll cover how cold weather can influence your vehicle’s insurance rates.

What Affects Your Car Insurance?

To understand how weather can impact your insurance rates, you must first understand how companies come up with the rates and what else can impact the premiums. The basis for any rate is how much financial risk the company takes on by insuring someone. There are several factors that companies look at when determining risk, but it all comes down to how much they suspect they’ll need to pay you in the end.

Your Vehicle

One of the biggest factors in your insurance is the vehicle you want to insure. The quality of your vehicle and the safety features of the car will impact the cost of your insurance in various ways. The more likely your vehicle is to break down, the higher your insurance will be. Additionally, the more protection your vehicle offers, the lower your premium.

Your Driving History

Your driving history has a significant impact on your insurance premium, as it informs the company if you’re a risk or not. The longer you go without a ticket or a bad mark on your record, the less of a risk you present for the company. This factor is why keeping a clean record is important, as it can lower your insurance payments and save you money.

Vehicle Mileage

Another factor that will impact your insurance payments is the mileage on your vehicle. Since older and used cars are more likely to break down, they’re a higher risk for insurance companies. So, you can expect your insurance rates to go up as the mileage increase on your vehicle.

Value of Vehicle

While an expensive vehicle can come with many safety features and extra protection, it also comes with a higher risk of a bigger payout for insurance companies. The more expensive a vehicle is, the more risk the company takes and the higher the premium will be because of it. However, safety features can still offset the extra value of the vehicle, depending on the circumstances.

State Requirements

Every state has a different set of requirements for vehicle insurance, which can change the cost of your premiums. Each region has different minimum insurance requirements, and the higher the requirements, the more you’ll pay for the insurance. This fact means that the state you live in can directly change your premium costs.

Special State Laws

Some states have more laws that affect insurance premiums than just the minimum requirements. For example, many states use the SR-22 system, which punishes people for breaking driving laws by requiring higher minimums for these individuals. This aspect can greatly increase premium costs for certain drivers. For example, you may need SR-22 insurance in Washington state. Only a handful of states do not utilize this system.

How Does the Cold Impact Insurance Rates?

Like all the other factors that impact insurance rates, cold weather affects the risk that the company takes on when insuring you. As most people who live in cold climates will tell you, the conditions that cold temperatures create aren’t safe to drive in if you don’t know what you’re doing. For a variety of reasons, cold weather increases the risk of accidents and breakdowns for drivers, no matter the vehicle.

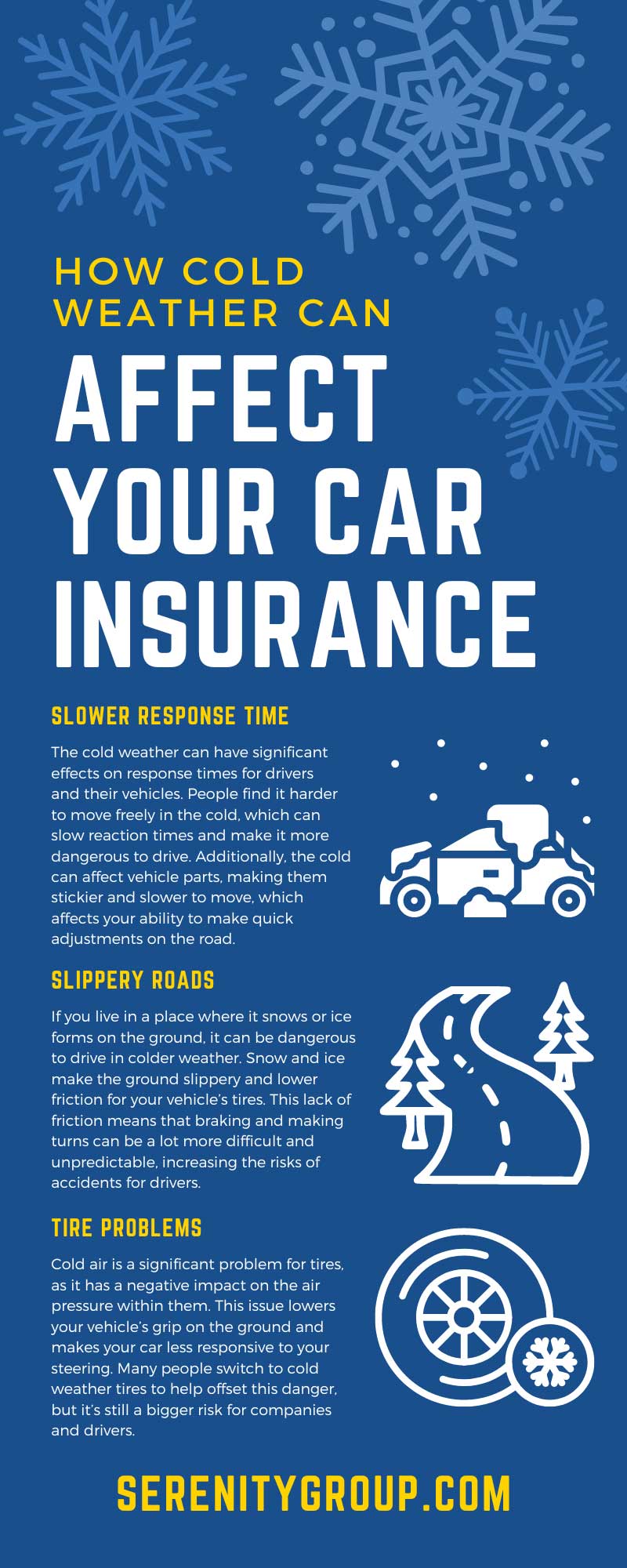

Slower Response Time

The cold weather can have significant effects on response times for drivers and their vehicles. People find it harder to move freely in the cold, which can slow reaction times and make it more dangerous to drive. Additionally, the cold can affect vehicle parts, making them stickier and slower to move, which affects your ability to make quick adjustments on the road.

Slippery Roads

If you live in a place where it snows or ice forms on the ground, it can be dangerous to drive in colder weather. Snow and ice make the ground slippery and lower friction for your vehicle’s tires. This lack of friction means that braking and making turns can be a lot more difficult and unpredictable, increasing the risks of accidents for drivers.

More Wear on Vehicles

Vehicles suffer more wear in the winter months, as parts suffer from the cold. Extreme temperature changes can really hurt a vehicle and make it break down, which will increase the risk to drivers and insurance companies.

Tire Problems

Cold air is a significant problem for tires, as it has a negative impact on the air pressure within them. This issue lowers your vehicle’s grip on the ground and makes your car less responsive to your steering. Many people switch to cold weather tires to help offset this danger, but it’s still a bigger risk for companies and drivers.

Blinding Ice and Snow

Snow is very effective at reflecting light from the sun, which can make it difficult to see when you’re driving around. It can be dangerous to drive in colder climates because of the snow, ice, and reflected sun rays that may hit your windshields as you drive.

Weather Damages

Cold weather also damages the body of your vehicle, as ice can scratch paint and lead to chipping very easily. Additionally, hail can put dents in your vehicle, and big enough chunks of it can break your windshields.

Salt and Vehicles

One of the best solutions to ice on the street is salt, which most cities spray on the ground when it’s going to snow. However, this salt can cause corrosive damage to your vehicle if you don’t clean it up quickly after driving on the street. This damage puts you at risk and may lead to more payouts from companies, so it contributes to higher insurance premiums in the winter.

What You Can Do

While the cold does affect your vehicular insurance rates, there are things you can do to offset it. Installing modifications like winter tires on your vehicle or investing in a car with several safety features can lower your premiums. Additionally, you can work with companies to negotiate lower costs and take classes to improve your driving record.

This breakdown should help you know what to expect when it comes to insurance rates in a cold climate and help you avoid the worst of the cost increases. Additionally, you can improve your safety while driving in the cold by understanding these factors and doing your best to avoid issues on the road.

Recent Comments