Everything You Need To Know About FR-44 Insurance

Each state has its own regulations and penalties for severe driving offenses. Those who have committed a serious offense will also face consequences related to their auto insurance. Drivers may need to file an FR-44 form to reinstate their driver’s license after such an occurrence. Because most drivers won’t need an FR-44 in their lifetime, many people don’t know its legal requirements. We will guide you through everything you need to know about FR-44 insurance.

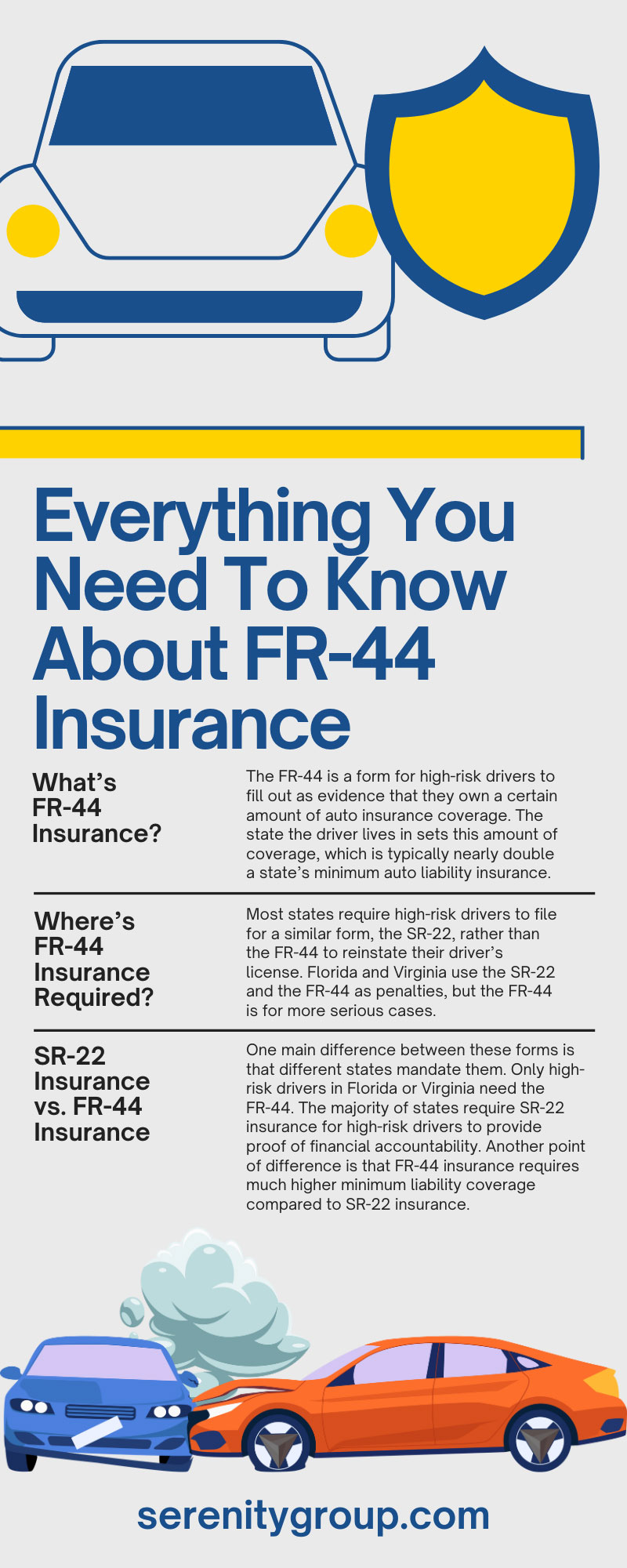

What’s FR-44 Insurance?

The FR-44 is a form for high-risk drivers to fill out as evidence that they own a certain amount of auto insurance coverage. The state the driver lives in sets this amount of coverage, which is typically nearly double a state’s minimum auto liability insurance.

The form serves as an extra step for people to acquire their driver’s license after a suspension. It doesn’t reinstate auto insurance coverage itself but is documentation that you have purchased the minimum amount of coverage for a high-risk driver.

Who Needs FR-44 Insurance?

The FR-44 is a punishment for people who have committed serious crimes behind the wheel. These drivers are high-risk because they have put themselves and/or others in danger on the road. Some of the most common offenses that require a FR-44 include:

- DUI/DWI

- Reckless driving

- Driving without insurance

- Driving with a suspended license

Other traffic law violations have the potential to result in a license suspension, and you’ll require the FR-44 form to reinstate it.

Where’s FR-44 Insurance Required?

A key trait of the FR-44 form is that it’s a punishment for severe driving offenses in only two states: Florida and Virginia. These states each have their own minimum liability requirements and other regulations for FR-44 certificates.

Most states require high-risk drivers to file for a similar form, the SR-22, rather than the FR-44 to reinstate their driver’s license. Florida and Virginia use the SR-22 and the FR-44 as penalties, but the FR-44 is for more serious cases.

SR-22 Insurance vs. FR-44 Insurance

The SR-22 and the FR-44 forms have a few main similarities. They both serve the same purpose—as required documentation of minimum liability insurance after committing a severe driving offense. They are typically punishments for similar infractions, such as DUIs or driving without a license.

One main difference between these forms is that different states mandate them. Only high-risk drivers in Florida or Virginia need the FR-44. The majority of states require SR-22 insurance for high-risk drivers to provide proof of financial accountability. Another point of difference is that FR-44 insurance requires much higher minimum liability coverage compared to SR-22 insurance.

FR-44 Insurance in Florida

Unlike Virginia, the FR-44 is applicable only in cases of driving under the influence in Florida and not other offenses that would consider a person a high-risk driver. For drivers with DUI convictions in Florida to reinstate their license, they must follow the state’s regulations to file for FR-44 coverage. Let’s go over the main details high-risk drivers in Florida should know about FR-44 insurance.

Required Amount of Coverage

The state of Florida mandates drivers file for a minimum amount of bodily injury and property damage liability insurance for all drivers. For the majority of drivers, their auto insurance must cover $10,000 for injury to one person, $20,000 per accident for bodily injury, and $10,000 for property damage at minimum. Florida drivers must also have $10,000 in personal injury protection (PIP) coverage on their policy.

However, the minimum coverage for high-risk drivers is substantially higher to qualify for the FR-44 form. Following a DUI, their policy must provide $100,000 per person for bodily injury, $300,000 per accident for bodily injury, and $50,000 for property damage.

How To Apply for FR-44 in Florida

A court will rule if you must obtain an FR-44 certificate after a DUI conviction in Florida. Afterward, it’s your responsibility to find a provider that offers a policy that meets the state’s minimum liability requirements. You should compare FR-44 insurance quotes in Florida to find the most affordable coverage. Once you have acquired a plan, your insurance company must file your FR-44 form to the Florida Department of Highway Safety and Motor Vehicles (FLHSMV) to verify coverage.

FR-44 Insurance in Virginia

Virginia’s uses for an FR-44 form are more broad than Florida’s, and Virginia’s minimum liability insurance is also lower. Now, we will go over the facts of obtaining an FR-44 certificate in Virginia.

Required Amount of Coverage

The state of Virginia has a higher minimum insurance limit than Florida. As of the time of writing, Virginia residents must have $30,000 for injury to one person, $60,000 per accident for bodily injury, and $20,000 for property damage on their auto insurance policy. They must also have additional uninsured/underinsured motorist bodily injury and property damage coverage worth $25,000/$50,000/$20,000.

The FR-44 doubles the minimum liability coverage a high-risk driver must have in Virginia. This coverage amounts to $60,000 for injury to one person, $120,000 per accident for bodily injury, and $40,000 for property damage.

How To Apply for FR-44 in Virginia

Filing for FR-44 insurance in Virginia is a similar process to Florida’s. You should compare quotes between different insurance providers for the required amount of auto insurance coverage. Then, you must inform the insurance company to send the FR-44 form to Virginia’s Department of Motor Vehicles (DMV) for approval.

How Much Does FR-44 Cost?

The considerable increase in minimum coverage will lead to high-risk drivers paying higher monthly premiums for auto insurance. The exact cost depends on various factors, such as your driving record and state mandates for auto coverage. The FR-44 form will remain active on your auto insurance policy for at least three years. Your insurance company also charges a one-time fee between $15 and $35 to send the FR-44 to your state’s DMV.

Finding the Right FR-44 Insurance for You

You need to be knowledgeable about the facts of FR-44 insurance so that you can easily reinstate your driver’s license after a suspension. We at Serenity Group understand that this is a lot of information to process, which is why we’re here to offer you guidance. Serenity Group offers affordable FR-44 insurance quotes to drivers in Florida and Virginia. Contact our team today.

Recent Comments