Common Questions People Have About FR-44 Insurance

In the USA, every state oversees its own laws and regulations regarding driving. This means you may only see a law in a few states, whereas all the other states do something completely different. That’s the case with the FR-44 punishment system, as it only applies in certain states nationwide. Because of its infrequency, many people have questions about the FR-44 and what it means to have it. This article will try to help answer some of the common concerns about the FR-44 and the insurance plans around it.

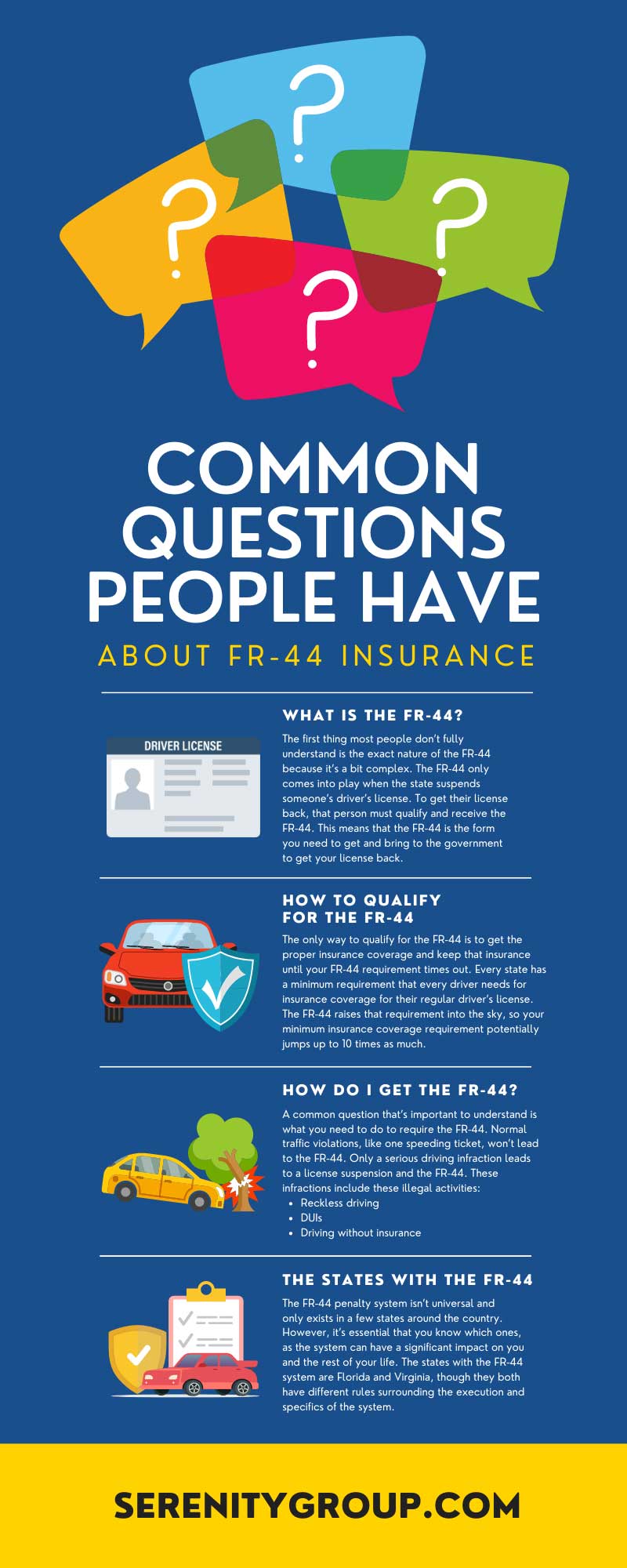

What Is the FR-44?

The first thing most people don’t fully understand is the exact nature of the FR-44 because it’s a bit complex. The FR-44 only comes into play when the state suspends someone’s driver’s license. To get their license back, that person must qualify and receive the FR-44. This means that the FR-44 is the form you need to get and bring to the government to get your license back.

How To Qualify for the FR-44

The only way to qualify for the FR-44 is to get the proper insurance coverage and keep that insurance until your FR-44 requirement times out. Every state has a minimum requirement that every driver needs for insurance coverage for their regular driver’s license. The FR-44 raises that requirement into the sky, so your minimum insurance coverage requirement potentially jumps up to 10 times as much.

How Do I Get the FR-44?

A common question that’s important to understand is what you need to do to require the FR-44. Normal traffic violations, like one speeding ticket, won’t lead to the FR-44. Only a serious driving infraction leads to a license suspension and the FR-44. These infractions include these illegal activities:

- Reckless driving

- DUIs

- Driving without insurance

While there are more cases and activities that can lead to the FR-44, this is the severity of driving infractions necessary to qualify for the punishment.

The States With the FR-44

The FR-44 penalty system isn’t universal and only exists in a few states around the country. However, it’s essential that you know which ones, as the system can have a significant impact on you and the rest of your life. The states with the FR-44 system are Florida and Virginia, though they both have different rules surrounding the execution and specifics of the system.

What You Need To Do

One of the more confusing things that come with the FR-44 is what you must do once the state requires you to have the form. The best action you can take is to contact local insurance companies to find someone to cover you and help you get FR-44 auto insurance. Be careful when looking for a company, and shop around for several options to find a company that offers you the best rates for the coverage you need because of the FR-44.

How Does It Affect My Insurance?

The FR-44 insurance requirements are much higher than the usual plans people use for their insurance. This means you’ll likely need more coverage from a new plan which naturally places more risk on the company covering you. That extra financial risk means you’ll likely have a higher monthly. The exact amount changes depending on your specific plans and the company you work with, but you can expect a big difference in your monthly payments with most companies.

Do Other Factors Affect My Rates?

One thing that confuses many people is how the rates change for insurance plans and what affects that final price. While the FR-44 plays a considerable part in determining the cost of your insurance, it’s not the only factor that’ll change your premium costs. There’s still the matter of your driving record, your vehicle, and your regular driving routes that can all heavily influence the price of your insurance plan. All the typical factors that affect your rates will still apply to the FR-44 insurance plan. However, that means you can also lower the costs with good practices. Things like:

- Driving classes

- Clean driving records

- Safe vehicles

- Safety modifications

These can all greatly influence the final cost of your insurance plans and help offset the higher costs of the FR-44 insurance.

How Long Does It Last?

One of the most common worries that come with the FR-44 insurance is how long you need it. It’s important that you know how long you need the insurance so you don’t pay for the insurance plan for too long and don’t disqualify yourself from the FR-44. In general, you need to keep the insurance plan for three years, though the court can determine a different length of time when they pass their judgment. This means you’ll need to keep up with your payments for the three years after you get the plan in the first place.

What To Do When It’s Over

At the end of those three years or however long the courts tell you to keep your FR-44 insurance, you no longer need to keep the plan. While the state should automatically know you don’t need the plan, your insurance company will likely keep you at the higher level of insurance until you tell them to stop. Once you’re off the FR-44 form, call your insurance company to change to a cheaper plan with less coverage to save money.

Difference From the SR-22

Many states use a system very similar to the FR-44, the SR-22. This system is very similar; however, each state has its own laws, just like with the FR-44. The main difference between these two systems is the insurance requirements, as the FR-44 has much higher requirements than is typical for the SR-22. Outside of that, there are not too many differences in the systems and how they function.

Understanding all these points will help you avoid an FR-44 and know what to do if you get one. All these points are important if you live in Virginia or Florida, as they can heavily impact your life for several years. However, the FR-44 isn’t a life sentence and is something you can work around with proper management and by finding a good insurance company to work with you.

Recent Comments