All You Need To Know About SR22 Insurance in Washington

There are many forms of punishment for people who break the law while driving, from something as simple as a fine to jail time to revoking your driver’s license. But one popular form of punishment in several states is the SR22. This form indirectly punishes people for their crimes and stays attached to your driving record for years. Not every state uses the SR22 form as punishment, but Washington is one of the states that does utilize this system. Here is what you need to know if you are given the SR22 in Washington and how it affects your insurance.

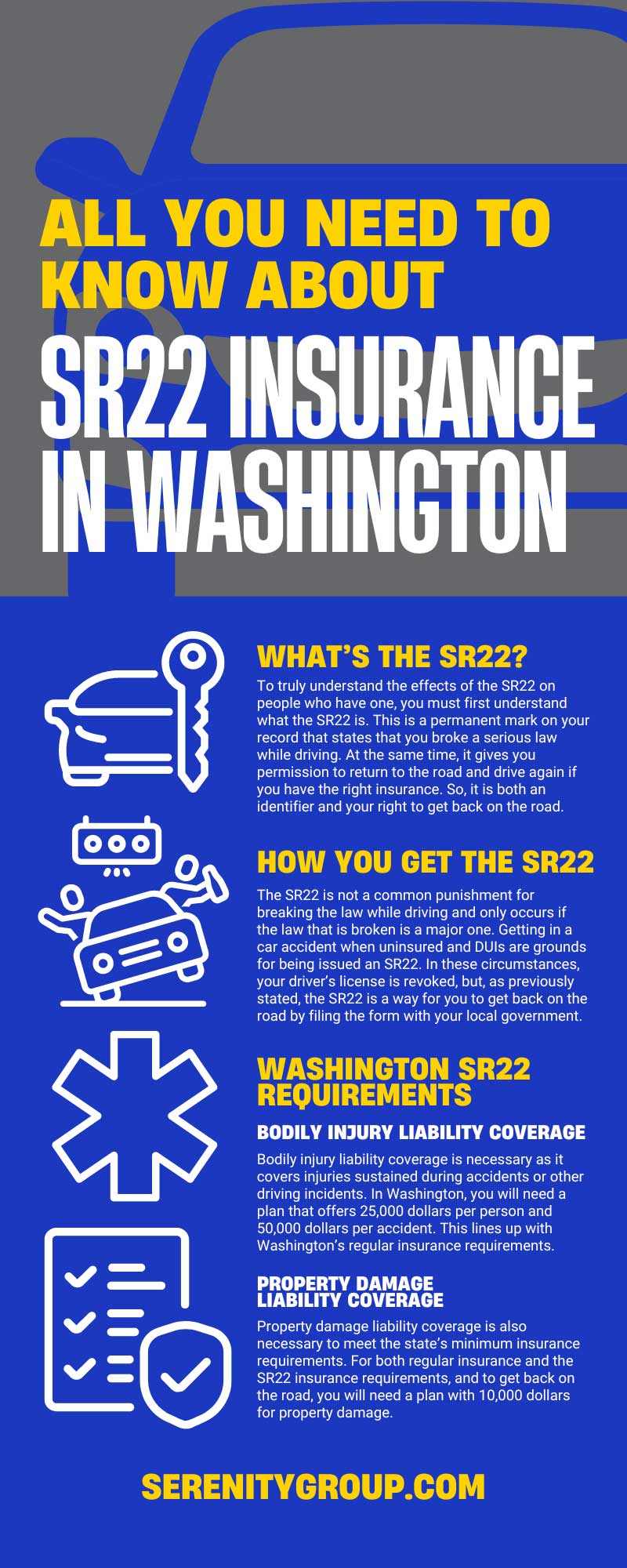

What’s the SR22?

To truly understand the effects of the SR22 on people who have one, you must first understand what the SR22 is. This is a permanent mark on your record that states that you broke a serious law while driving. At the same time, it gives you permission to return to the road and drive again if you have the right insurance. So, it is both an identifier and your right to get back on the road.

What It Means for You

The SR22 means a lot for the people who receive one, but the main thing is that you can start driving again as long as you get the right insurance. In a more practical sense, this means you will need to pay a lot more for your insurance than you would without the SR22. Insurance companies will know if you have an SR22 and will identify you as a risky driver because of it. Because you are a risk to the company, you will need to pay larger insurance premiums.

How You Get the SR22

The SR22 is not a common punishment for breaking the law while driving and only occurs if the law that is broken is a major one. Getting in a car accident when uninsured and DUIs are grounds for being issued an SR22. In these circumstances, your driver’s license is revoked, but, as previously stated, the SR22 is a way for you to get back on the road by filing the form with your local government.

Length of SR22

Once you get your SR22, you will need it for years to come to qualify for your driver’s license. Each state has its own laws regarding the length of time you will need to keep your SR22, but Washington uses a simple system. Barring no mistakes, you will need the SR22 for three years after first receiving it. This means you cannot default or lose your insurance for any reason for those three years, or else the insurance company can report you, and you may lose your license again.

Washington SR22 Requirements

Washington state’s SR22 requires every person to have a certain level of insurance to maintain their license. This insurance covers more than the state’s basic insurance requirements to help offset the risks of letting a dangerous driver back on the road. Here are some specific requirements for the level of insurance you need to qualify for the SR22:

Bodily Injury Liability Coverage

Bodily injury liability coverage is necessary as it covers injuries sustained during accidents or other driving incidents. In Washington, you will need a plan that offers 25,000 dollars per person and 50,000 dollars per accident. This lines up with Washington’s regular insurance requirements.

Property Damage Liability Coverage

Property damage liability coverage is also necessary to meet the state’s minimum insurance requirements. For both regular insurance and the SR22 insurance requirements, and to get back on the road, you will need a plan with 10,000 dollars for property damage.

How it Affects Insurance Costs

The main thing to note about how the SR22 will affect your insurance costs is how expensive your insurance premium will be. Even if you get the exact same insurance as someone else, you may have higher premium costs because you have the SR22. This form indicates that you are not a safe driver, and the insurance company will take that into account when determining the costs of your insurance plan. You can take measures to lower your costs by knowing what other factors play into insurance costs. Factors such as a safer car or attending driver safety programs can help offset the costs added by having an SR22.

Insurance Companies

It is important to note that insurance companies have no legal reason to take you on as a client if you have an SR22. So, you may struggle to use the same insurance companies that you utilized in the past. However, you can still find many insurance companies that are willing to work with you if you reach out to them. Some even offer cheap SR22 insurance in Washington, which is perfect for helping offset the increase in premiums because you have a bad mark on your record.

Getting New Rates Once Your SR22 is Over

After the three years pass and you no longer need to have the SR22 because you followed all the rules and regulations, your prices will not automatically decrease. While your insurance company might know that you do not have the SR22 anymore, you need to inform the state that you are compliant and that they need to remove it from your record. Once that is done, and your record is clean, you can look to reduce your rates at your insurance company. Talk with your insurance provider and see if you can work out a new deal because the state now considers you a safe driver.

With this information on what you need to know about SR22 insurance in Washington, you can better understand how it can affect you if you or someone you know has one. While SR22s are not a life sentence in Washington, they can be a big hassle, and it is much better if you can avoid getting one in the first place. But, even if you do get an SR22, you can still drive as you need, just at a slightly higher price than before.

Recent Comments