All You Need To Know About FR-44 Insurance in Florida

After significant traffic violations, drivers in Florida and Virginia may be forced to submit FR-44 forms to their Departments of Motor Vehicles (DMV) in order to have their licenses reinstated. Contrary to the name, FR-44 insurance in Florida is not actually insurance but rather documentation that a driver has satisfied the state’s mandatory minimum coverage requirements for vehicle insurance. If you want to know more, read on—we have all you need to know about FR-44 insurance in Florida below.

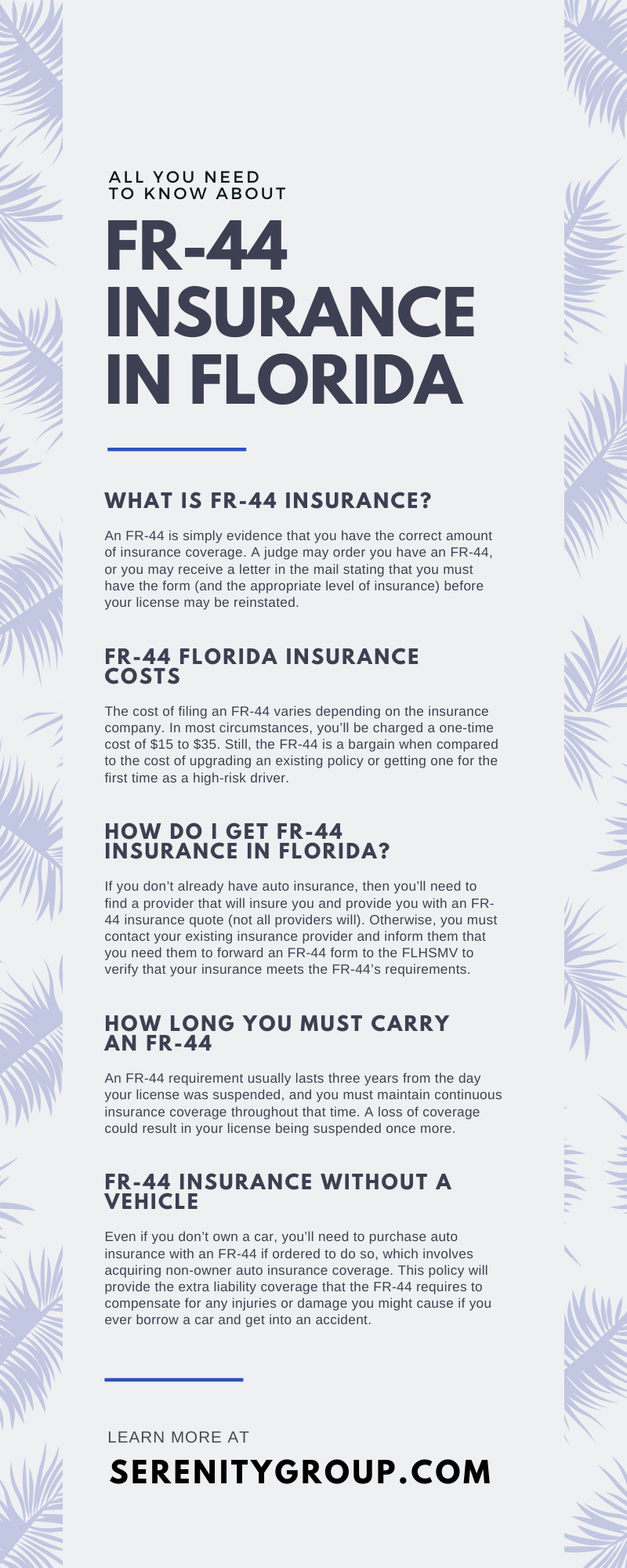

What Is FR-44 Insurance?

An FR-44 is simply evidence that you have the correct amount of insurance coverage. A judge may order you have an FR-44, or you may receive a letter in the mail stating that you must have the form (and the appropriate level of insurance) before your license may be reinstated. This might be because you were recently convicted of a DUI or another significant traffic violation or found driving without auto insurance.

If you don’t currently have auto insurance, you’ll have to look for an insurance carrier that will cover you. You may be unable to obtain insurance from a standard or local carrier, depending on the provider and the severity of your conviction; in this case, you’ll need to seek out a business that specializes in insuring high-risk drivers. These businesses have licenses that allow them to certify and issue special types of insurances, and they’ll let the court know that the paperwork process has been carried out.

FR-44 vs. SR-22

FR-44s and SR-22s have a lot in common. Both require drivers to produce proof to the Florida Department of Highway Safety and Motor Vehicles (FLHSMV) that they have the required level of vehicle insurance. Both are used after significant driving infractions, such as DUIs, but there are some key distinctions between the two.

In most cases, FR-44s are utilized only in Virginia and Florida. However, even if you’re from another state, you may still need an FR-44 if a Virginia or Florida judge mandates you to have one. Otherwise, you risk losing your license and registration.

The most significant distinction between the two forms is that FR-44s require you to acquire twice the state’s minimum liability limit. Drivers in Florida who must meet the insurance requirements of an FR-44 must have a policy with the following liability coverage limits:

- $100,000 per person for bodily injury

- $300,000 per accident for bodily injury

- $50,000 per accident for property damage

FR-44 Florida Insurance Costs

The cost of filing an FR-44 varies depending on the insurance company. In most circumstances, you’ll be charged a one-time cost of $15 to $35. Still, the FR-44 is a bargain when compared to the cost of upgrading an existing policy or getting one for the first time as a high-risk driver.

The FR-44’s secondary cost depends on the quantity of insurance you’ll need. The cost of the minimum coverage required to meet the FR-44 will almost certainly be significant, as it’s double the amount of coverage required for Florida drivers. But the cause for the FR-44’s implementation in the first place will determine the true cost of your overall insurance coverage. If you’ve been convicted of a DUI, the DUI conviction on your record—not the FR-44—will have the largest effect on the cost of your auto insurance premium.

Insurance companies may view DUI convictions as signs of high-risk driving conduct. Drinking and driving continues to be a leading cause of death on America’s highways, resulting in a huge volume of insurance claims each year. As a result, drivers with DUI records who require FR-44s may be forced to pay higher insurance costs alongside their already-expensive FR-44 certificates.

How Do I Get FR-44 Insurance in Florida?

If you don’t already have auto insurance, then you’ll need to find a provider that will insure you and provide you with an FR-44 insurance quote (not all providers will). Otherwise, you must contact your existing insurance provider and inform them that you need them to forward an FR-44 form to the FLHSMV to verify that your insurance meets the FR-44’s requirements. Your auto insurance company will then automatically issue the insurance certificate.

Can I Be Issued an FR-44 From Another State?

The only other state that regularly issues FR-44 auto insurance is Virginia. Most other states employ SR-22s, which do not require drivers to acquire additional coverage beyond the state’s minimal liability limitations. Remember that even if you move to another state, the Florida FR-44 requirements will most likely follow you for the term of the judge- or state-ordered FR-44 mandate. Therefore, checking with your new state to be sure the insurance certificate can indeed move over is a good idea.

How Long You Must Carry an FR-44

An FR-44 requirement usually lasts three years from the day your license was suspended, and you must maintain continuous insurance coverage throughout that time. A loss of coverage could result in your license being suspended once more.

When your contract expires, you’ll almost certainly be able to obtain significantly lower insurance rates if you haven’t had any further violations; however, this might not happen immediately, so budget appropriately.

FR-44 Insurance Without a Vehicle

Even if you don’t own a car, you’ll need to purchase auto insurance with an FR-44 if ordered to do so, which involves acquiring non-owner auto insurance coverage. This policy will provide the extra liability coverage that the FR-44 requires to compensate for any injuries or damage you might cause if you ever borrow a car and get into an accident. You’ll almost certainly need to call several insurance agents or organizations to compare prices for a non-owner policy; you won’t be able to receive a non-owner policy quote online.

We hope you know have everything you need to know about FR-44 insurance in Florida. If you’re looking to get a great FR-44 insurance quote for Florida, reach out to Serenity Group. We offer great rates and are dedicated to making the whole insurance process as painless as possible, including in cases that require specialty high-risk insurance certificates such as the FR-44 or SR-22. The best part is that we have operations in a variety of states to make our services as accessible as possible.

Recent Comments