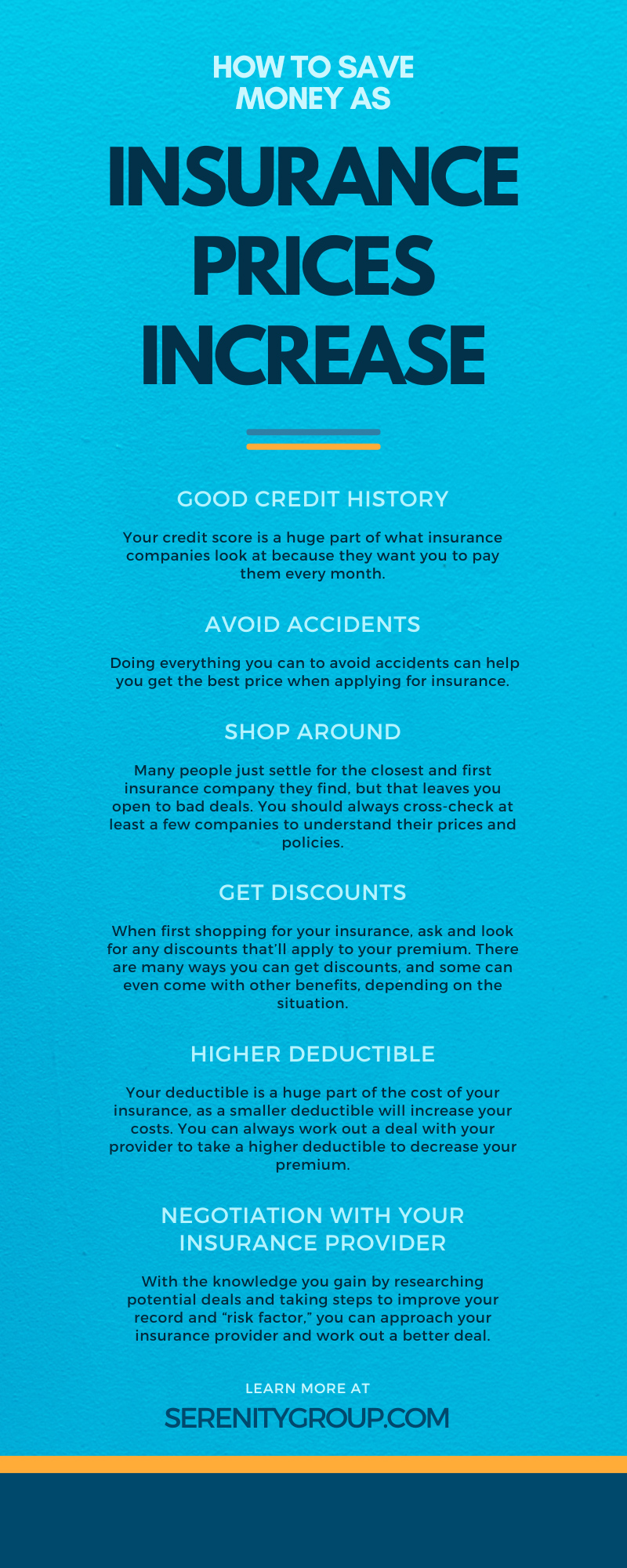

How To Save Money as Insurance Prices Increase

Insurance costs can be a huge issue for many people, but it’s almost impossible not to have them. That’s why learning some ways you can lower your insurance prices despite the increases is important. Here’s a guide you can utilize to help lower your costs when it comes to your insurance plan.

What You Can Do Beforehand

Before you even start looking for insurance, whether you’re changing or buying your first plan, there’s some steps you can take to help lower your costs and make yourself more appealing as an applicant.

Good Credit History

Your credit score is a huge part of what insurance companies look at because they want you to pay them every month. If they believe that you can’t pay them, they’re unlikely to take you as a client. Additionally, the lower your score is the riskier you are as a client, so they’ll increase your premium.

Avoid Accidents

Accidents are a big cause for premium increases as insurance companies will then see you as a risky driver. Even if the accident isn’t your fault, the insurance company may still increase your premium. Doing everything you can to avoid accidents can help you get the best price when applying for insurance.

Deal with Your Driving Record

If you do have something negative on your driving record, you can normally remove it if enough time has passed or by participating in some driver’s education courses. Contact your local government to work on removing these marks from your record to help you avoid higher premiums. You need to qualify for these classes first, which normally includes waiting a few years without having another incident, but it changes depending on the state. For example, the SR22 insurance quotes from California will be higher, but you can lower it if you can get rid of your SR22 by contacting your government.

How To Get Less Expensive Insurance

When it comes to things you can do to actively reduce your insurance costs you’ve many options and programs you can participate in. Here are a few steps you can take to directly lower your costs.

Shop Around

Many people just settle for the closest and first insurance company they find, but that leaves you open to bad deals. You should always cross-check at least a few companies to understand their prices and policies. This way you can find the best deal possible.

Group Insurance

To determine the cost of premiums, some insurance companies categorize vehicles into groups. Some vehicles are in lower insurance groups which means that someone driving these cars will have a lower insurance policy premium. You can always ask about these group insurance policies to choose which vehicle you want to help lower your premium.

Get Discounts

When first shopping for your insurance, ask and look for any discounts that’ll apply to your premium. There are many ways you can get discounts, and some can even come with other benefits, depending on the situation. Purchasing your insurance online is a common discount, as many companies offer a deal for shopping online.

Driving Programs

Improving your driving record is a great way to get a better price for your insurance and participating in driving programs is a great way to do that. While you can have negative marks on your record due to accidents, participating in a driving program will help you get positive marks. Look for safety courses or defensive driving training to make your record shine.

Better Vehicle Features

Your vehicle can have a huge impact on the costs of your insurance policies, but you can improve your costs by adding safety features for your vehicle. Improving your vehicle with additional safety precautions, such as better airbags or obstacle detection, can improve your safety while you drive and lower your premiums at the same time.

Low-Mileage Insurance

For those who drive less than 8,000 miles a year, low-milage insurance is a great way to save money. Many companies offer plans with massive discounts or pay-per-mile plans that save more money over normal plans.

Changing Your Insurance

Once you get your insurance policy, the premium isn’t set in stone. You can often still improve your costs with the proper methods and steps. Here are some of the easier methods you can use to improve your premium costs once you’ve secured a plan.

Loyalty Program

Almost every insurance company utilizes a loyalty program, and you can benefit from these programs over time. A loyalty program offers discounts and other benefits to people who use the same insurance company for a long time. This is a great way to fight rising insurance costs as you get more and more discounts over the years.

Higher Deductible

Your deductible is a huge part of the cost of your insurance, as a smaller deductible will increase your costs. You can always work out a deal with your provider to take a higher deductible to decrease your premium. However, if you do this you may spend more if something happens and you need to file a claim.

Bundling Your Insurance

You can save some money if you can bundle your insurance as well. Many companies offer different types of insurance services, and you can buy them in bundles to get them for a lower cost. See if the company you choose will offer you a bundle that’ll help lower the cost of your premium.

Negotiation with Your Insurance Provider

With the knowledge you gain by researching potential deals and taking steps to improve your record and “risk factor,” you can approach your insurance provider and work out a better deal. You’ll need to advocate for yourself, but you can negotiate with them to come up with a better deal after they reassess you. This is a key part of lowering your insurance prices even though they keep increasing.

These methods will help you get the best price possible when it comes to your insurance policy and premium. By focusing on your driving record and working with your insurance providers, you can improve your insurance premium. You can also improve your premium over time by maintaining a consistently clean driving record and implementing discounts.

Recent Comments