How SR-22 Insurance Can Affect Your Job Search

The SR-22 is something you need to get your driver’s license back after the state revokes it for breaking the law. However, to get the form, you must fit the state’s specific requirements. In most cases, this means that you need to meet a higher minimum coverage for your insurance to get your license back. This results in a higher premium as you pay more for coverage, and you can’t let your insurance lapse, or the state may revoke your license.

Due to these higher payments, you may start searching for a job that will allow you to pay them. However, SR-22 insurance can affect more than your insurance rates. In many cases, it can also impact your ability to find a job.

Issues Applying for a Job

The SR-22 insurance has lasting impacts on all aspects of your life. There are many ways that this insurance requirement can impact your life and make things more difficult. In this next section, we’ll cover how SR-22 insurance can make things harder for you when searching for a new job.

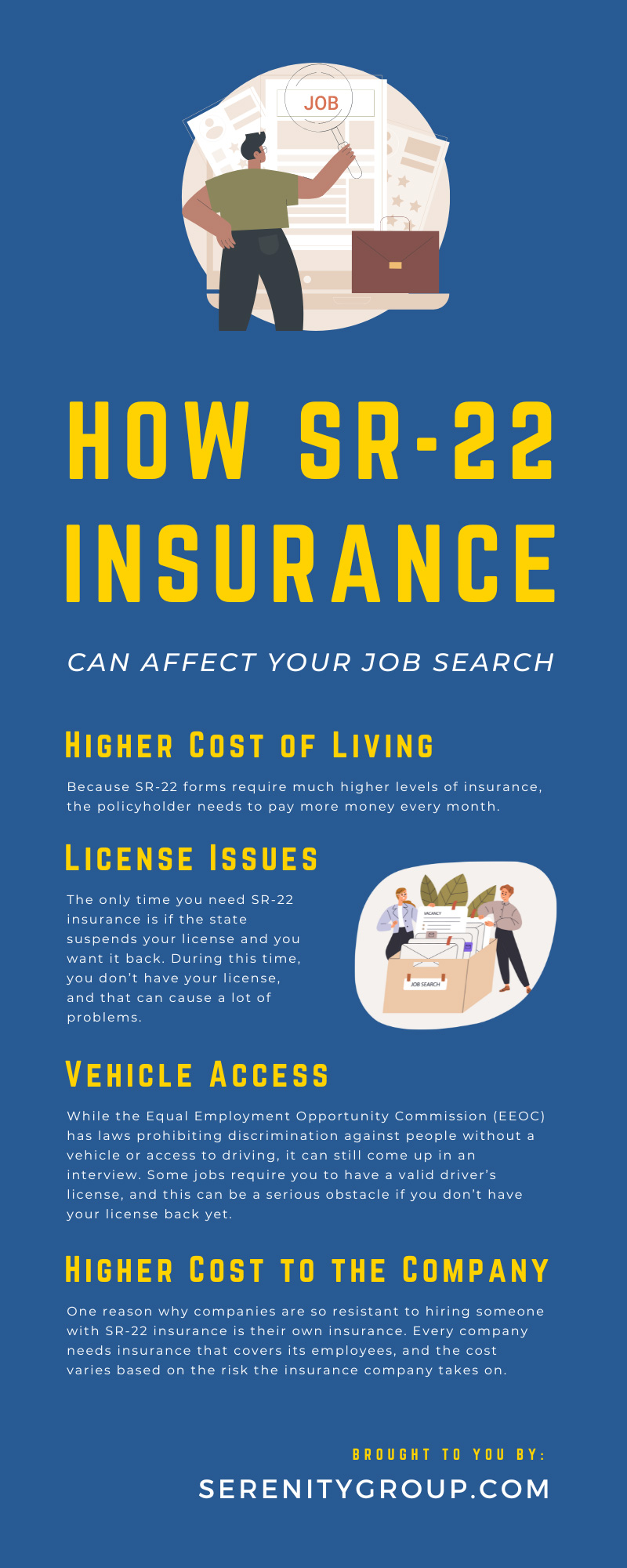

Higher Cost of Living

Because SR-22 forms require much higher levels of insurance, the policyholder needs to pay more money every month. This increases your cost of living and puts a bigger strain on your budget. This can cause numerous problems in your life, like needing to find a new job to pay for the extra costs. However, you can try to offset this by switching to a new policy or company that offers cheap SR-22 insurance online.

License Issues

The only time you need SR-22 insurance is if the state suspends your license and you want it back. During this time, you don’t have your license, and that can cause a lot of problems. Most workplaces require a valid ID when you apply for a job, which is a lot harder to provide if you don’t have a valid driver’s license. While there are other methods, this is another roadblock that can get in your way.

Vehicle Access

While the Equal Employment Opportunity Commission (EEOC) has laws prohibiting discrimination against people without a vehicle or access to driving, it can still come up in an interview. Some jobs require you to have a valid driver’s license, and this can be a serious obstacle if you don’t have your license back yet. However, this shouldn’t be a problem once you get your license back, even if you’re on SR-22 insurance.

Higher Cost to the Company

One reason why companies are so resistant to hiring someone with SR-22 insurance is their own insurance. Every company needs insurance that covers its employees, and the cost varies based on the risk the insurance company takes on. Someone who needs more insurance because of a license suspension is a big risk, potentially increasing the cost to the company.

Reason for SR-22 Insurance Requirement

In most cases, having SR-22 insurance isn’t a real problem when it comes to finding a new job. Plenty of people have higher levels of insurance, and it doesn’t cause them any issues. It’s not the SR-22 insurance that’s the problem; rather, it’s why someone needs the insurance in the first place. The only people who need the SR-22 form are those the state finds guilty of major crimes and driving infractions. Things like driving while under the influence or reckless driving are common indictments leading to the SR-22.

Criminal Charges

The requirement for an SR-22 form is just one of the many punishments that come with a guilty verdict in serious cases. While the exact punishment varies depending on the charges and your state, many include big fines and potential jail time. This can have a huge impact on your ability to search for a job, as spending time in jail will hurt your resume.

Permanent Record

The only time you need SR-22 insurance is when you break the law, which has a large impact on your job search. When someone breaks the law, it goes on their permanent record, which is visible to potential employers and can result in people not hiring them. Depending on the crime, the charge may eventually disappear and no longer affect your chances of finding work. However, most serious crimes will last years or may always be on your permanent record.

Background Checks

One of the biggest obstacles you’ll face when searching for a new job while on SR-22 insurance is background checks. Every company and job should run these checks before hiring someone to ensure they find the best person for the job. However, they’ll likely see your permanent record and see the fact that you’ve broken the law t. Be honest about your record in the interview so that you can avoid wasting your time and theirs. You can also expunge the record in some cases, especially if you no longer need the insurance for your license.

Current Job Status

While getting a new job is difficult when you’re on SR-22 insurance, you may also struggle with your current job. While it likely won’t have as big of an impact on your job, there are multiple ways that needing an SR-22 form can affect your work and your status at your job. Here’s one of the biggest potential changes.

Responsibility Changes

Some jobs have certain responsibilities that involve needing a legal driver’s license. It’s common for companies to change your job and responsibilities if you can’t drive anymore. For example, a personal driver without a license may need to take a new position at their job until they can legally drive again. It’s also possible to lose your job because of a conviction, but that depends heavily on the job and the crime.

Understanding how SR-22 insurance can affect your current work and any potential jobs is important. Knowing will help you make the best decisions during your search. You can also use this as a guide to what you should do if you used to be on insurance and no longer need it, as it stays on your record.

Recent Comments