All You Need To Know About FR44 Insurance in Virginia

FR44 insurance isn’t insurance; it’s only paperwork that proves you have the proper car insurance coverage. In some circumstances, it’s referred to as a Certificate of Financial Responsibility (CFR). When you’ve been convicted of a significant traffic offense or caught driving without insurance, you’ll need an FR44. In most circumstances, your license has been suspended, and to get it reinstated, you must show the state that you have the proper auto insurance, which an FR44 accomplishes.

In most states, the form that verifies you have car insurance is known as an SR22. Only two states necessitate the use of an FR44, Florida and Virginia. The FR44 form has more stringent criteria than an SR22 and, in most circumstances, higher rates. Here we’ll provide you with all you need to know about FR44 insurance in Virginia.

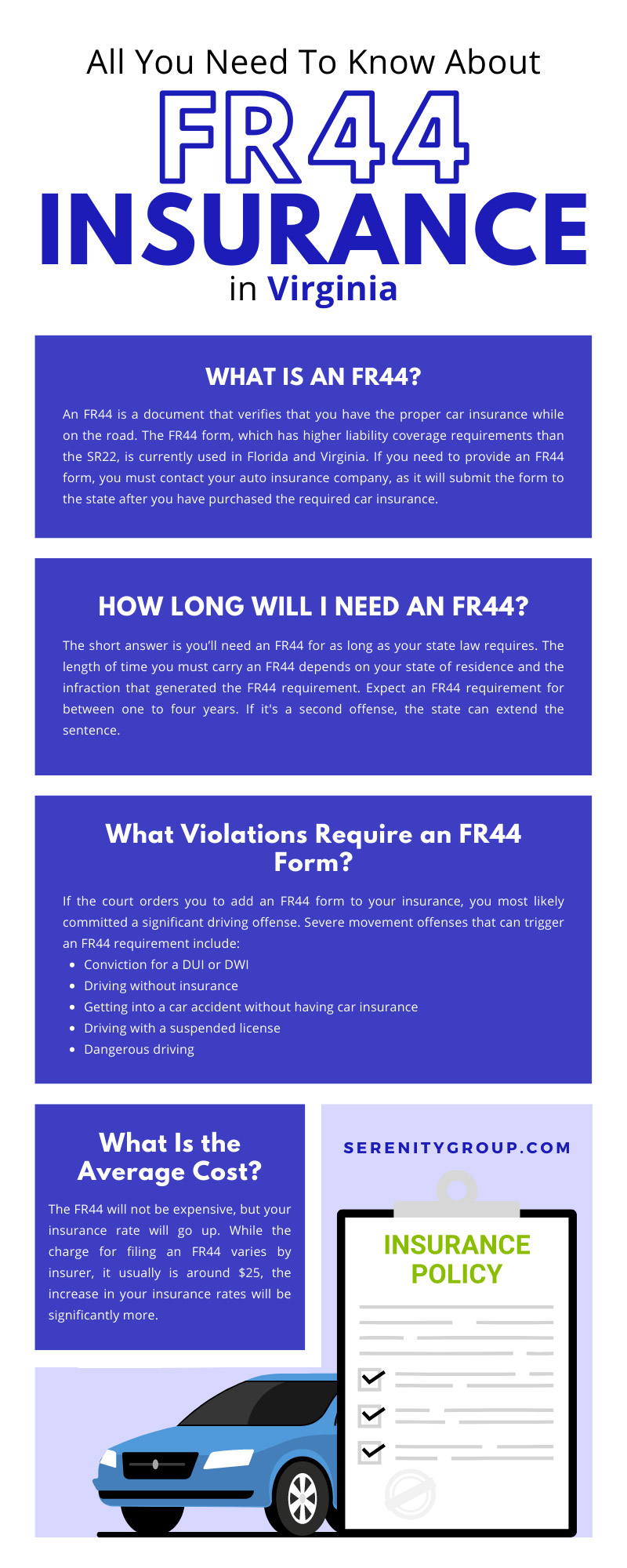

What Is an FR44?

An FR44 is a document that verifies that you have the proper car insurance while on the road. The FR44 form, which has higher liability coverage requirements than the SR22, is currently used in Florida and Virginia. If you need to provide an FR44 form, you must contact your auto insurance company, as it will submit the form to the state after you have purchased the required car insurance. Your insurance company will send the form to the DMV in your area, which will subsequently reinstate your driver’s license.

If you don’t pay your insurance or let it lapse, your insurer will withdraw your FR44 and alert the DMV, who will suspend your license. Your driving rights may be restricted even further. If you drive without insurance, the DMV takes it incredibly seriously, and you can face serious consequences.

How Long Will I Need an FR44?

The short answer is you’ll need an FR44 for as long as your state law requires. The length of time you must carry an FR44 depends on your state of residence and the infraction that generated the FR44 requirement. Expect an FR44 requirement for between one to four years. If it’s a second offense, the state can extend the sentence. Suppose you cancel your policy after getting your license restored or let your insurance lapse for any reason. In that case, they will revoke the FR44, and your license will be suspended again, often for an extended time.

If you commit any additional traffic offenses during your FR44 period, there is a strong likelihood that the state will prolong your FR44 requirement. You can typically drop your FR44 once you’ve completed the appropriate criteria to get your full license reinstated. Still, it’s advisable to double-check with your DMV before searching for new insurance to be sure you’re in the clear.

What Violations Require an FR44 Form?

If the court orders you to add an FR44 form to your insurance, you most likely committed a significant driving offense. Severe movement offenses that can trigger an FR44 requirement include:

- Conviction for a DUI or DWI

- Driving without insurance

- Getting into a car accident without having car insurance

- Driving with a suspended license

- Dangerous driving

The requirements for getting your license reinstated after a conviction will be communicated to you by your local DMV or court. This should include information about an FR44 requirement and its duration.

What Is the Average Cost?

The FR44 will not be expensive, but your insurance rate will go up. While the charge for filing an FR44 varies by insurer, it usually is around $25, the increase in your insurance rates will be significantly more.

Insurance companies will now classify you as a high-risk driver, which will result in a significantly higher premium. When determining a premium, insurers analyze many factors, including your driving record, residence, type of automobile, and even your credit score. A serious traffic violation and an FR44 request are never good news when it comes to affordable insurance.

The FR44 places you in a group of high-risk drivers rather than a regular pool of drivers. Because insurers predict that dangerous drivers will make more claims, you will undoubtedly pay significantly more for auto insurance after the FR44. In addition to paying a higher premium, the court may require you to carry higher coverage limits than before, which will increase your costs.

You must have bodily injury liability insurance worth $50,000/$100,000 and property damage liability insurance worth $40,000 in Virginia. The standard limits for bodily injury and property damage are $25,000/$50,000 for physical injury and $20,000 for property damage.

What Is the Difference Between SR22 and FR44

The most significant distinction between the two is the quantity of necessary insurance and the states that utilize them. As previously stated, the FR44 is now exclusively used in Florida and Virginia. The amount of liability insurance necessary is also a significant variance. For example, in Florida, FR44 insurance is mandated to cover $100,000/$300,000 in bodily injury liability and $50,000 in property damage liability.

An SR22 in Florida, on the other hand, requires that a motorist has $10,000 of bodily injury liability per person and $20,000 of bodily injury liability per accident, and $10,000 of property damage liability coverage per accident.

How To Find Affordable FR44 Insurance

If you want to save money on your insurance, the best advice we can offer is to shop around. Insurers assess risk differently, resulting in significantly different premiums, so be sure to look into several insurance agencies for your coverage, especially if an FR44 is necessary.

Many states have subsidiary firms that provide insurance after a DUI and coverage to people with poor driving records. In addition to collecting rates from the main carriers, you should consider smaller vehicle insurance companies specializing in high-risk, or “non-standard,” coverage.

We hope you have found our recap of all you need to know about FR-44 Insurance in Virginia. If you are looking to purchase FR44 Insurance in Virginia, reach out to Serenity Group today!

Recent Comments