A Beginner’s Guide to Understanding No-Fault States

When you get into an accident, there are specific procedures you should follow to ensure you don’t make any other mistakes. One of these tasks is identifying who is at fault for the accident. It’s a mistake to try to establish guilt the moment after the accident, as you should wait for a lawyer and the police. But insurance will likely require information establishing who was at fault for the accident. However, that’s only true if you don’t live in a no-fault state; otherwise, you’ll follow an entirely different system. Here’s what you need to know about living in a no-fault state.

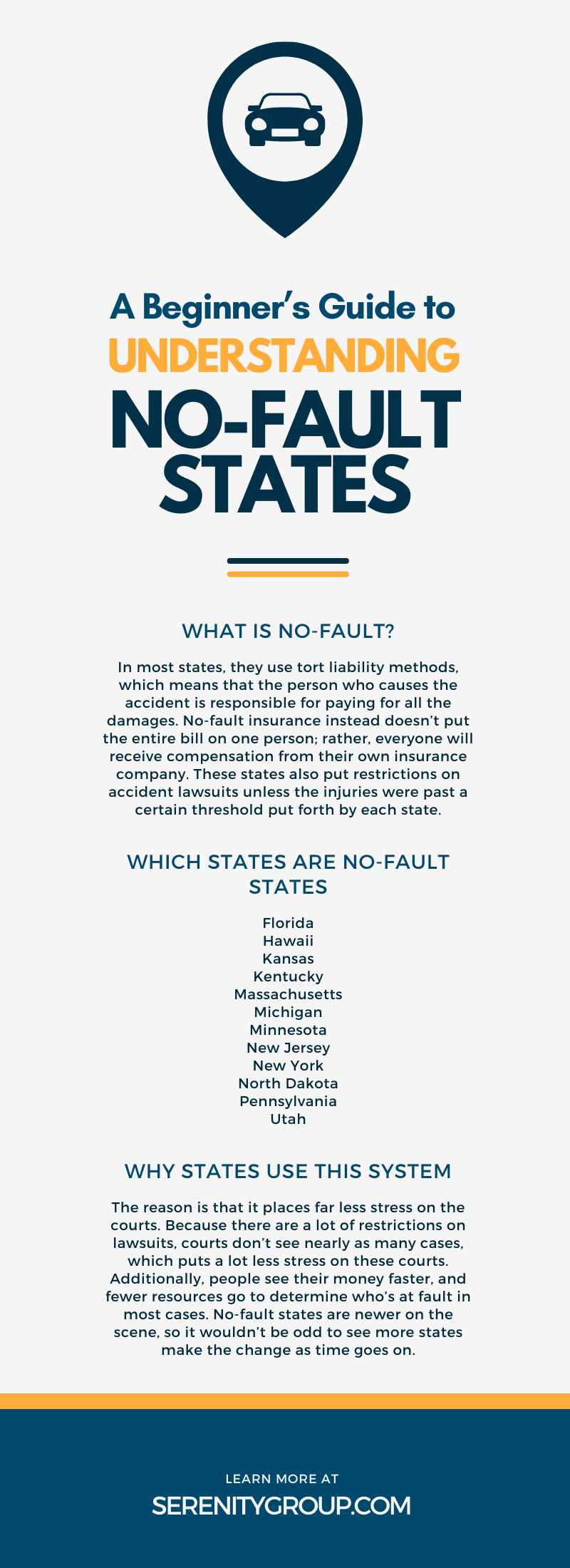

What Is No-Fault?

To start, it’s best that you understand what no-fault means in the case of a car accident. In most states, they use tort liability methods, which means that the person who causes the accident is responsible for paying for all the damages. They use their insurance to cover the price of repairs and damages from the accident or pay out of pocket if they don’t have insurance. No-fault insurance instead doesn’t put the entire bill on one person; rather, everyone will receive compensation from their own insurance company. These states also put restrictions on accident lawsuits unless the injuries were past a certain threshold put forth by each state.

Which States Are No-Fault States

Currently, 12 states use this no-fault policy. Anyone living in these states can use a no-fault policy when purchasing an insurance plan from a provider. These twelve states are:

- Florida

- Hawaii

- Kansas

- Kentucky

- Massachusetts

- Michigan

- Minnesota

- New Jersey

- New York

- North Dakota

- Pennsylvania

- Utah

Different Types of No-Fault

Every state controls its own policies and regulations around insurance laws, but they generally try to use similar systems. When it comes to no-fault, three laws affect both how the state looks at an accident and how insurance pays out. Here’s a look at these different types of no-fault laws.

Normal No-Fault

The most common type of no-fault law is the state-wide law that states that each individual insurance pays out no matter who’s at fault for the accident. It depends on the state and the plans of every individual, but no-fault insurance covers things like medical bills and lost income for the driver and passengers in the vehicle in most accidents.

Choice No-Fault

Choice no-fault is another type of state law where drivers can opt for a no-fault option or go for the more traditional form of insurance. This isn’t a common occurrence, as only three states currently offer choice no-fault insurance:

- Kentucky

- New Jersey

- Pennsylvania

You need to make the decision when you first purchase your insurance plan.

Add-On No-Fault

Some states offer a dual insurance system, where you can get the standard tort liability insurance with an add-on that works similarly to no-fault insurance. These plans cover you no matter who’s at fault for the crash, which can be a great way to protect yourself further if something goes wrong while driving.

How Does It Affect You

While understanding how insurance works is nice and important if you live or drive through a no-fault state, it’s more important to understand how it affects you directly. A few things change when you live in a no-fault state that can heavily influence how things work for you, not just in an accident. This next section will cover what might be different for you because you live in a state with no-fault laws.

Increase in Insurance Rates

When looking at getting insurance in a no-fault state, you should note that your premiums will likely cost more than in a state with at-fault insurance policies. The additional risk the company takes by covering for an accident, even when you’re not at fault, means higher premiums for you. However, you can offset this increase, along with other increases to your insurance, by things like the FR-44, with something like the FR-44 insurance in Florida.

What Happens After an Accident

Another big difference for anyone on a no-fault insurance plan is what happens if you’re in an accident. It’s important that you know what you’re doing after an accident, as you don’t want to end up in more legal trouble or somehow make things more difficult for yourself. That’s why you must be careful and understand what to do after an accident.

Everything’s the Same…

If you ever find yourself in the unfortunate situation of getting in an accident, you need to follow the standard procedures. Take stock of your health and the health of your passengers. Try to move out of the way of oncoming traffic, if it’s possible, by going to the closest safe location. The next step is to call the police and report everything you can to them. Then get your police report and call a tow truck if necessary. You should also exchange information with the other drivers in the accident. You’ll want to contact your insurance provider as soon as possible, too, along with a lawyer. While you live in a no-fault state, it’s still best practice to avoid talking about whose fault it was that caused the accident to avoid legal issues.

Except for the Insurance Payout

While dealing with the accident is the same as in any other state, the big difference is how it affects your insurance payout. With at-fault states, insurance companies must deliberate and wait until they know who caused the accident. Then the person at-fault pays for the accident with their insurance provider. A no-fault accident doesn’t need to wait and can pay out a lot faster because of it. This can have a significant impact on your life after an accident.

Why States Use This System

So why do some states use these no-fault insurance policies over the more standard tort liability policies? The reason is that it places far less stress on the courts. Because there are a lot of restrictions on lawsuits, courts don’t see nearly as many cases, which puts a lot less stress on these courts. Additionally, people see their money faster, and fewer resources go to determine who’s at fault in most cases. No-fault states are newer on the scene, so it wouldn’t be odd to see more states make the change as time goes on.

That’s just about everything you need to know about no-fault states and how it affects you. This is important to know if you live in any of the states that use these systems, as it can impact your financial health significantly.

Recent Comments