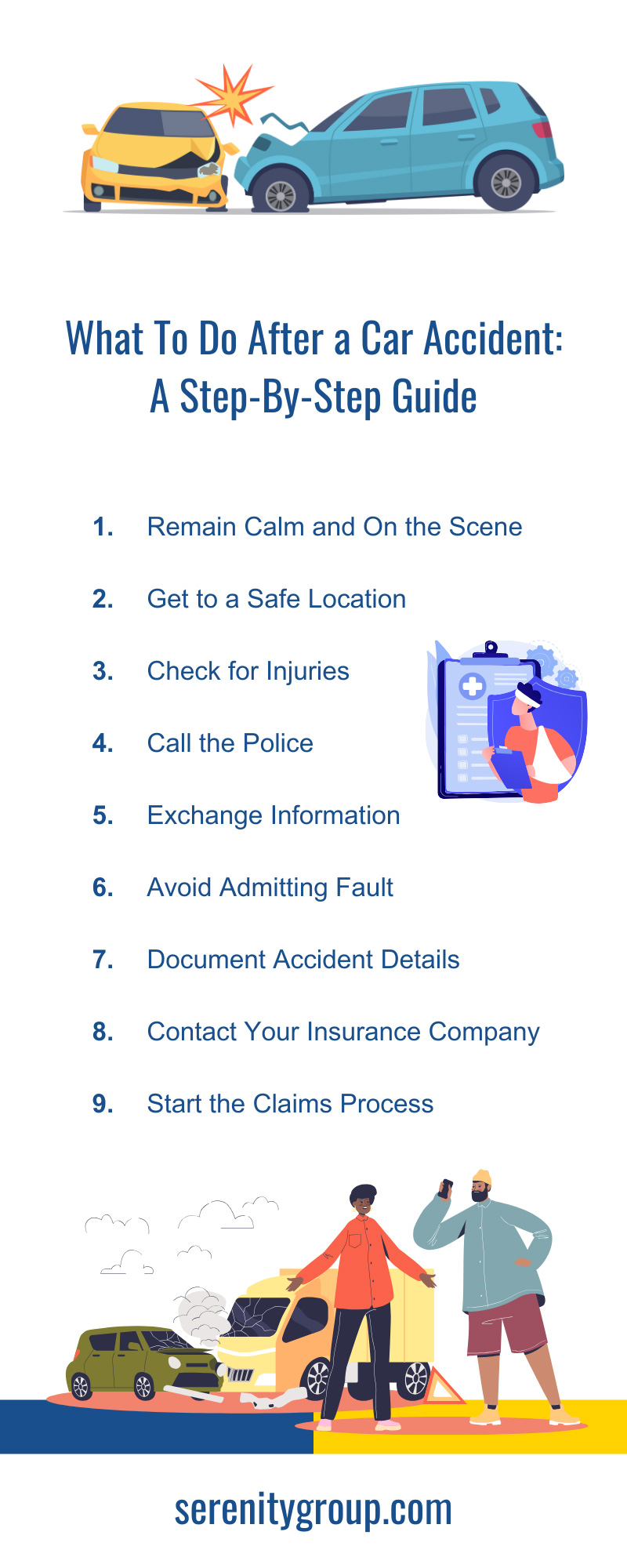

What To Do After a Car Accident: A Step-By-Step Guide

Whenever you are in a car accident, the key is to remain calm and follow a set of steps to streamline the insurance claims process. Knowing what steps to take after a car accident can make a big difference in how well you handle the situation. By following the advice in this guide, you can navigate the stressful aftermath of an accident with confidence and efficiency, increasing your chances of a smooth claims process. This guide will walk you through exactly what to do at the scene of an accident and the days following to help you make wise decisions.

Remain Calm and On the Scene

If your vehicle has been involved in a collision with another vehicle, remain calm and soothe yourself. Accidents can be jarring, but panicking will only make things worse. If you feel shaken, take a moment to collect yourself. The calmer you are, the better you will handle the next steps.

Drivers have a legal obligation to remain at the scene of the accident, even if they do not intend to file an insurance claim. Staying at the scene is crucial for the following steps and erring on the side of caution. At this moment, you may be unaware of damage to your vehicle or injuries to the other driver that should be recorded for insurance purposes.

Get to a Safe Location

Once you have composed yourself, move to a safe location if possible. If your car is in the middle of traffic, try to move it to the side of the road. Turn on your hazard lights to alert other drivers. If you can’t move your car, stay inside with your seatbelt fastened until help arrives. The goal is to prevent further accidents and ensure everyone’s safety. Stay alert and be cautious as you move to a safe area.

Check For Injuries

After ensuring your safety, check yourself and your passengers for injuries. Even if they seem minor, addressing them immediately is important. Do not hesitate to call 911 if you or a passengers are seriously injured. Provide clear information to the operator about the number of people injured and the nature of their injuries.

Do not try to move anyone who is seriously injured unless they are in immediate danger. Wait for medical professionals to arrive so you or your passengers’ health and safety are not compromised.

Call the Police

To report an accident, you or the other involved parties should contact the police. Although this may seem unnecessary, some state laws require motor vehicle accidents to be reported. A police report is also often required for insurance claims as a primary source for determining fault.

On the 911 call, provide them with accurate information about the accident, including a first-hand account of what you experienced without making assumptions. Provide dispatchers with a description of how they can easily and quickly reach the scene of the collision. Answer the dispatcher’s questions to the best of your ability and remain cooperative.

Exchange Information

After ensuring everyone’s safety and contacting the police, exchange information with the other driver. This includes names, addresses, phone numbers, insurance details, and vehicle information. Acquiring this information will be essential for filing an insurance claim and having a robust police report.

Additionally, take note of the other vehicle’s license plate number and the contact information of any witnesses. The more information you gather, the smoother the claims process will be.

Avoid Admitting Fault

As you are communicating with other involved parties in the collision, you must not say any direct or implied admissions of fault. This can come about in a variety of ways in natural conversation. Avoid statements that paint you as a negligent driver or as being responsible for the accident due to your actions.

Furthermore, do not apologize or say you are sorry for the accident occurring. Statements like these could be held against you by law enforcement and the other driver’s insurance company as taking the blame. Admitting fault can complicate the claims process and have legal implications.

Document Accident Details

One of the most important steps to take at the scene of a car accident is documenting the event for legal and insurance records. Write down important information on your phone or on a piece of paper while details about the collision are fresh in your mind. Include the time, date, weather conditions, and any other relevant information. Besides the other driver and any passengers, write down the name and badge numbers of responding officers and any witnesses.

Take the opportunity to take several pictures on your phone of property damage and bodily injuries. Capture these key details from several angles and use your hand or objects around you to accurately reflect the scale. Your records will help ensure the accuracy of your insurance claim and any potential legal proceedings.

Contact Your Insurance Company

Notify your insurance company about the accident as soon as possible and provide them with all the information you have gathered. Be honest and accurate in your account of the accident without admitting fault or taking responsibility. Your insurer will guide you through the documentation required to proceed and how your coverage will be applied to cover accident-related expenses.

Start the Claims Process

Lastly, file a claim through your insurance provider to ensure that you receive funds to cover medical and property expenses from the accident. This will require submitting several sources of information for an agent to determine fault and issue reimbursements. Be patient and cooperative throughout the process. The more prepared you are, the quicker your claim will be resolved.

Dealing with a car accident can be overwhelming, but knowing what steps to take can help you manage the situation effectively. Stay calm, prioritize safety, and follow this step-by-step guide to ensure a smooth post-accident process. If you are found at fault for the accident and require SR-22 insurance to reissue your license, Serenity Group has your back.

Serenity Group provides cheap SR-22 insurance in California and many other states for high-risk drivers. If you need further assistance, feel free to reach out to our team.

Recent Comments