What Is Commercial Auto Insurance and Why Do You Need It?

There are many different types of auto insurance on the market, which can make it confusing to pick the right one for your needs. As a business or company that uses automobiles, understanding the different types of insurance available is important as it impacts your expenditures and risks greatly. That’s why you should do everything you can to learn about commercial auto insurance and why it’s something you need.

What Is Auto Insurance?

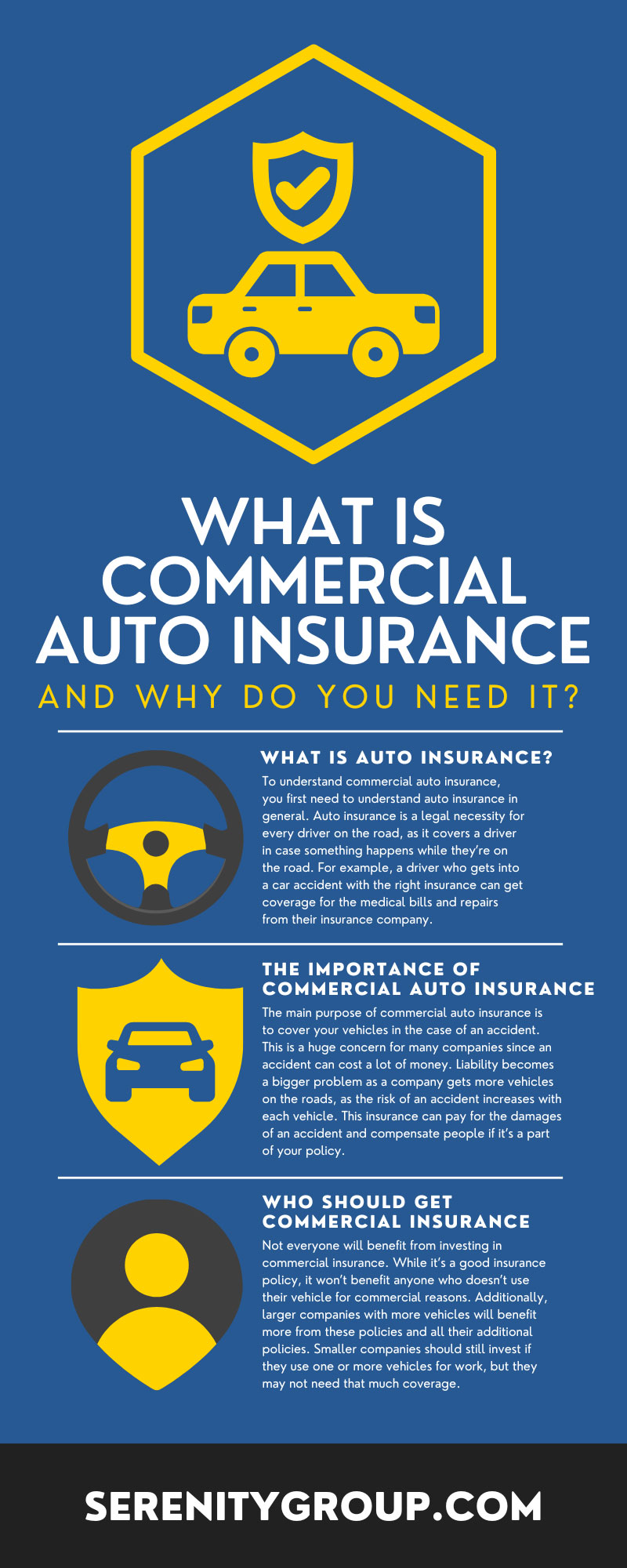

To understand commercial auto insurance, you first need to understand auto insurance in general. Auto insurance is a legal necessity for every driver on the road, as it covers a driver in case something happens while they’re on the road. For example, a driver who gets into a car accident with the right insurance can get coverage for the medical bills and repairs from their insurance company.

Defining Commercial Auto Insurance

Commercial auto insurance is a type of auto insurance that specifically bundles benefits and deals for commercial companies. These policies normally cover a variety of situations that personal auto insurance doesn’t cover.

What Vehicles Does It Protect?

Commercial auto insurance protects vehicles in the use of a company rather than protecting the vehicle at all times. However, this means that any vehicle in the service of a company is under this insurance as long as they are performing work or are property of the company.

The Importance of Commercial Auto Insurance

It may seem odd to have a separate type of insurance to cover vehicles under a company, but it comes with many benefits for the company. For example, you can protect a wide range of vehicles with one insurance policy rather than buying multiple for each vehicle you have. Here’s a look at some of the important features of commercial auto insurance.

Liability Protection

The main purpose of commercial auto insurance is to cover your vehicles in the case of an accident. This is a huge concern for many companies since an accident can cost a lot of money. Liability becomes a bigger problem as a company gets more vehicles on the roads, as the risk of an accident increases with each vehicle. This insurance can pay for the damages of an accident and compensate people if it’s a part of your policy.

Medical Coverage

Depending on the specific policy and features you add to your deal, you may get medical coverage as a part of your commercial insurance. Medical coverage means that the insurance company will pay for any medical bills for those in the accident in accordance with what the policy allows. This is a big benefit to a company as medical bills can cost a lot, especially if there were multiple injuries in the accident.

Repair Coverage

While liability covers legal expenses and medical will cover any medical bills, someone still needs to pay for the repairs. Vehicle and product damage is common in the case of a vehicular accident, which can get expensive if you need to pay for it yourself. Some commercial auto insurance policies will pay for repairs and possibly replace vehicles if it’s necessary and a part of your policy. This can help you quickly recover your equipment without drawing money out of your company’s pocket.

Beyond Personal Insurance Policies

A big part of these commercial insurance policies is how far they go to protect the insurance holder. Personal insurance policies cost a lot of money if you want the same level of coverage as commercial plans. Additionally, you can get more coverage for a variety of different circumstances.

Coverage Regardless of Fault

A big part of personal insurance is determining who’s at fault for an accident in states that use at-fault insurance. You must determine who’s at fault, as that person’s insurance will foot the bill for the whole accident. Commercial insurance focuses on getting your money back to you as soon as possible, so it often ignores fault and covers the accident quickly to get you back to normal as quickly as possible.

Who Should Get Commercial Insurance

Not everyone will benefit from investing in commercial insurance. While it’s a good insurance policy, it won’t benefit anyone who doesn’t use their vehicle for commercial reasons. Additionally, larger companies with more vehicles will benefit more from these policies and all their additional policies. Smaller companies should still invest if they use one or more vehicles for work, but they may not need that much coverage.

How It Can Benefit Your Business

Before you invest in commercial auto insurance for your business, you should consider how it will improve your business and benefit you in the short and long term. To help you understand what you’re investing in for your company, here’s a look at the benefits that come with commercial auto insurance.

Protecting Your Business

When you constantly use vehicles and have a lot of them in your employ, accidents will happen and cause all sorts of damage and potential injuries. This can cost a lot of money, which your company will need to pay out of pocket if you don’t have the proper coverage. This can ruin a business as they can’t pay off the money they owe, and it cuts into their profits too much. Insurance can protect you from this if you invest in a good insurance policy.

Saving Money

Understanding commercial auto insurance should help you understand why it’s so important for your business. However, another reason why you should consider this type of insurance is that it can save you more money than other insurance plans can. Cheap commercial auto insurance is great as it bundles exactly what you need for your vehicles, which makes it significantly less expensive than buying the insurance policies separately.

Any company that uses vehicles in any capacity can benefit from commercial auto insurance. That’s why each business should seriously consider the type of insurance they should get. A good commercial auto insurance plan can save a lot of money and protect the business from a variety of legal and monetary problems in the future.

Recent Comments