The Difference Between Broad Form and Full Coverage

When it comes to auto coverage, broad form car insurance is a less expensive alternative because it simply covers one driver with the bare minimum of liability coverage. This means that any other person who drives your automobile is not covered. This form of coverage is only provided in a few states due to the high level of risk. Here are some of the major differences between broad form and full coverage insurance!

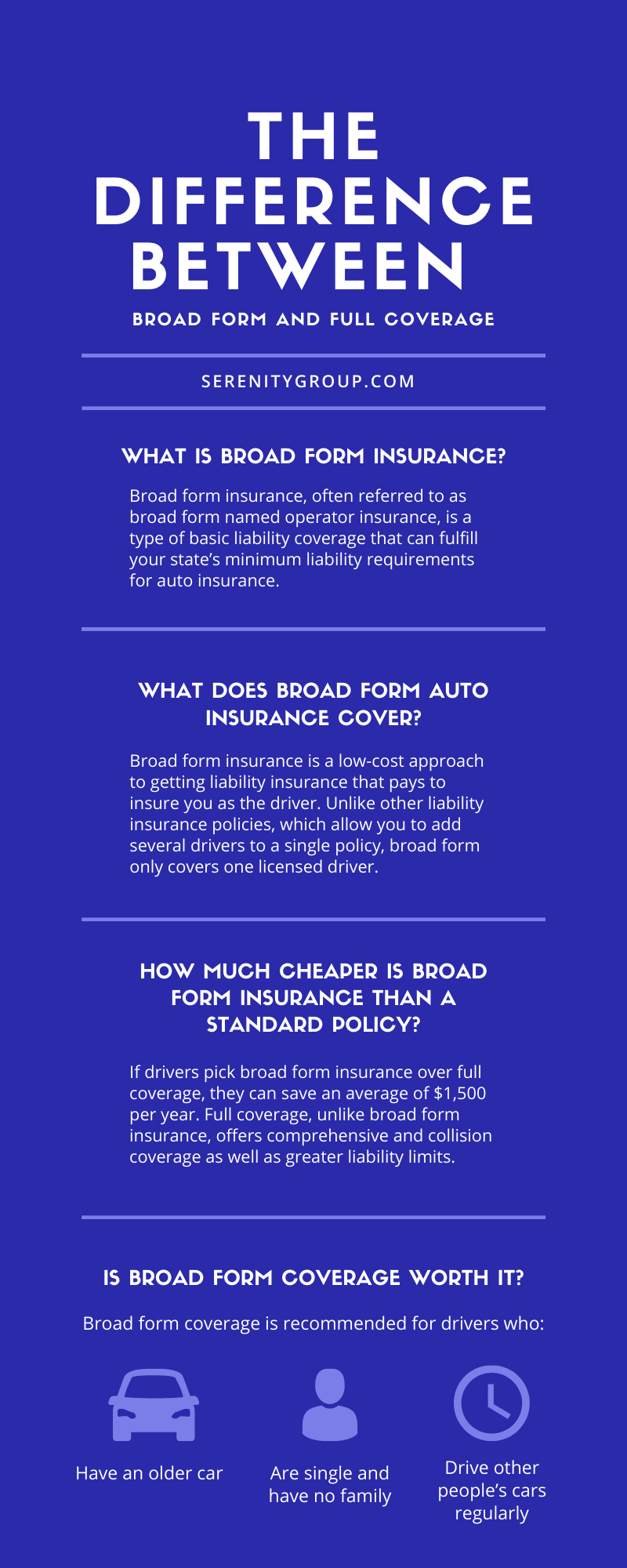

What Is Broad Form Insurance?

While the term “broad form” seems to suggest a wide range of coverage, it’s actually the opposite. Broad form insurance, often referred to as broad form named operator insurance, is a type of basic liability coverage that can fulfill your state’s minimum liability requirements for auto insurance.

This type of policy covers only the driver’s liability costs. Broad form may appeal to people who want to pay as little as possible for insurance and only need to cover their own liability, not that of any family members.

However, broad form insurance may not be available to every driver looking for low-cost coverage. It’s only legal in a few states right now, one of which is Washington. When it comes to what broad form insurance covers, there are some restrictions.

What Does Broad Form Auto Insurance Cover?

Broad form insurance is a low-cost approach to getting liability insurance that pays to insure you as the driver. However, there is one major distinction in broad form. Unlike other liability insurance policies, which allow you to add several drivers to a single policy, broad form only covers one licensed driver.

This insurance will not cover any motorist not listed as a named driver on the policy. As a result, broad form coverage is recommended for drivers who do not allow anybody else to operate their vehicle.

You do not have to pay for additional vehicles under your broad form insurance if you own or drive multiple cars. Non-owner car insurance, on the other hand, is a better fit if you don’t own a car. Because most states need some kind of liability coverage, a broad form liability insurance policy can be a cost-effective solution, especially for single-car owners.

Should You Get Broad Form Insurance?

Consider the following questions when evaluating whether broad form insurance is a good fit for you:

- What are some of the advantages of broad form insurance over other types of coverage?

- Does broad form insurance have any limitations?

- Is broad form insurance the most cost-effective solution for me?

We recommend broad form coverage for customers who are looking for low-cost insurance, own a low-value automobile, or drive other vehicles that they do not own.

Benefits of Choosing Broad Form Coverage

In practice, broad form is the same as liability-only coverage for a single driver. As a result, you can save a lot of money on your monthly premium. You cannot add family members to your broad form policy, unlike standard liability coverage.

You won’t need supplementary driver coverage if no one else will be driving your vehicle. Because providing coverage for additional drivers and passengers can be costly, broad form insurance may be a cost-effective alternative.

While not available in every state, this policy can help you meet the minimum liability requirements to drive legally in states like Washington. This kind of insurance is best for drivers who want the bare minimum of coverage and:

- Do not have children or dependents

- Drive alone

- Own a low-value vehicle

- Do not own their car

How Much Cheaper Is Broad Form Insurance Than a Standard Policy?

If drivers pick broad form insurance over full coverage, they can save an average of $1,500 per year. Full coverage, unlike broad form insurance, offers comprehensive and collision coverage as well as greater liability limits. When choosing broad form coverage, however, there is some risk because the insurance company is only responsible for the driver listed on the policy. We’ve substituted the cost of minimum liability insurance for one driver and vehicle for the cost of broad form insurance because the rates are similar. However, broad form policies may be even cheaper.

Drawbacks of Broad Form Insurance

While broad form insurance may be a less expensive option in terms of coverage, it does not allow you to add or acquire comprehensive or collision coverage.

As a result, if you are at fault in an accident, you, not the insurance provider, will be solely responsible for any damages to your car or passengers. If you total your automobile, you will not receive any compensation from your insurance company.

Broad form insurance does allow drivers to acquire personal injury protection (PIP) and uninsured motorist coverage, which can help cover medical costs in the event of an accident.

Broad form coverage will be deemed secondary insurance if you do not own a car and frequently drive someone else’s. To put it another way, if the car owner has insurance, claims will be filed on their primary policy before your broad form auto insurance.

Although some jurisdictions offer broad form insurance expressly for motorbikes, broad form insurance does not cover company-owned cars or those operating a motorcycle or RV. Broad form car insurance isn’t right for everyone, especially if you drive a modern vehicle or frequently transport family or other passengers.

Is Broad Form Coverage Worth It?

Broad form auto insurance is the most basic coverage available to automobile owners and drivers. Broad form coverage is recommended for drivers who:

- Have an older car

- Are single and have no family

- Drive other people’s cars regularly

If you need to add other family members to your policy or own a newer vehicle, you may want to look into other options. In the end, the decision about how much money to spend on protection is yours to make. Consider your financial condition and if you have sufficient reserves to cover vehicle damage in the event of an at-fault accident.

We hope you have enjoyed our recap of some of the major differences between broad form and full coverage insurance! If you are looking to purchase broad form auto insurance, reach out to Serenity Group today for great service and amazing rates!

Recent Comments