3 Things To Know When Your is FR-44 Expiring

The FR-44 is a complex punishment system that some states utilize to protect citizens from people who drive under the influence. DUIs are extremely serious, as driving while intoxicated can easily lead to great injury or even death. That’s why states have serious punishments for those who break the law. However, the FR-44 doesn’t last forever, and there are some things you should know when your FR-44 is expiring.

What Is the FR-44?

First, you need to understand what an FR-44 is and how it works. When someone breaks the law by driving while under the influence, some states revoke their license for an extended period so they can’t drive again. The FR-44 is a form that people need from their insurance company to clear them to regain their licenses.

States that Require the FR-44

Every state has its own penal code, which means not every state uses the same methods of punishment. In fact, only two states currently use the FR-44 as a form of punishment for people who drive while under the influence. Those states are Virginia and Florida, each of which has its own laws surrounding the FR-44.

What Constitutes the FR-44?

State governments don’t give out FR-44 punishments to every person who breaks the law while driving, only those who break specific laws. While the state can revoke your license for a variety of reasons, you only need the FR-44 to regain your license if you drove while under the influence of drugs or alcohol.

How Is it Different from the SR-22?

There’s another form of punishment very similar to the FR-44 that many states use for a similar purpose: the SR-22. However, the requirements for the SR-22 are much easier to meet when you want to get your license back. Additionally, states issue the SR-22 for a variety of crimes, while the FR-44 is only for those who commit a DUI.

What Does it Mean To Have the FR-44?

The FR-44 isn’t just a form that says you can get your license back; it’s a certificate that states you meet certain insurance levels. These levels are higher than the normal requirements of the state, which is why it’s a punishment. The higher levels offer more protection to you and everyone else on the road. It also costs more money since you pay higher premiums for better coverage. Additionally, your insurance company can see your record indicates you’re a reckless driver, resulting in increased premiums.

Virginia’s FR-44

Even though only two states currently use the FR-44, they don’t have the same laws for the forms. Each state has different requirements and practices for those who receive the FR-44. The two major differences are the length of the FR-44 and the insurance you need to get your license back. This section will look at the FR-44 of Virginia.

Length Of the FR-44

Simply put, people with regular licenses will have the FR-44 for 36 months after conviction or revocation. However, incurring any infraction or missing an insurance payment may result in the state revoking your license again. Additionally, the time might be longer if you have a restricted license, lasting between 48 months and four years.

FR-44 Insurance

You need an insurance plan that meets or exceeds these requirements to qualify for the FR-44 in Virginia before you can regain your license. Qualifying plans include $40,000 in property damage liability, $50,000 per person in bodily injury liability, and $100,000 per accident in bodily injury liability. Though, you can find cheap FR-44 insurance in Virginia by contacting companies that specialize in it.

Florida’s FR-44

This section will tackle the primary information you need to know about the FR-44 for the state of Florida. This is important to understand what you need and what you can expect if the state revokes your license for a DUI.

Length Of the FR-44

In most situations, you only need to keep it for three years. However, the time the state keeps the FR-44 depends on your situation and case.

FR-44 Insurance

Like Virginia, insurance plans are much more expensive for the FR-44 than the state minimum. Florida requires $100,000 of bodily injury liability per person, $300,000 of bodily injury liability per accident, and $50,000 of property damage liability per accident.

What Happens Next?

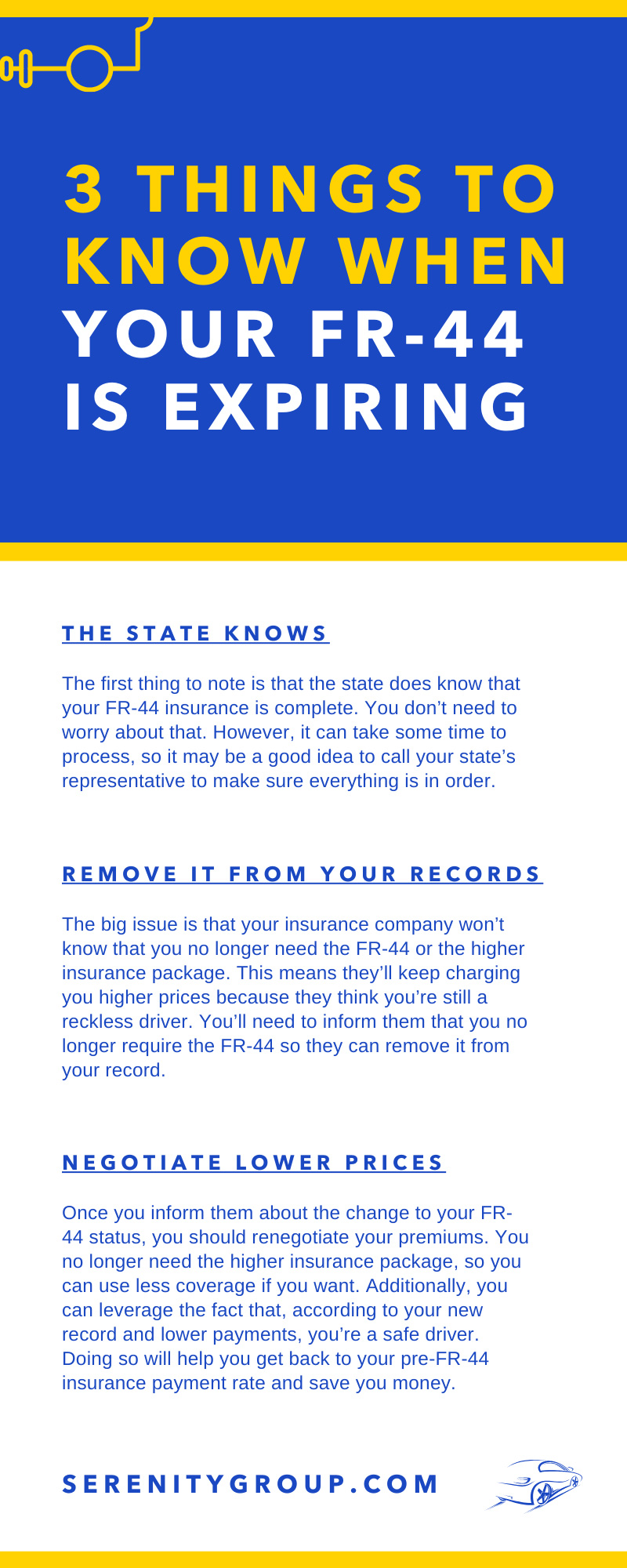

Making it through your three-year period with the FR-44 should be everyone’s goal, but there are some steps you’ll need to take once the period ends. While the FR-44 won’t officially be in effect, you may still feel the ramifications if you don’t go through these steps. This is what you should know about your FR-44 expiring.

The State Knows

The first thing to note is that the state does know that your FR-44 insurance is complete. You don’t need to worry about that. However, it can take some time to process, so it may be a good idea to call your state’s representative to make sure everything is in order.

Remove it From Your Records

The big issue is that your insurance company won’t know that you no longer need the FR-44 or the higher insurance package. This means they’ll keep charging you higher prices because they think you’re still a reckless driver. You’ll need to inform them that you no longer require the FR-44 so they can remove it from your record.

Negotiate Lower Prices

Once you inform them about the change to your FR-44 status, you should renegotiate your premiums. You no longer need the higher insurance package, so you can use less coverage if you want. Additionally, you can leverage the fact that, according to your new record and lower payments, you’re a safe driver. Doing so will help you get back to your pre-FR-44 insurance payment rate and save you money.

The FR-44 is a big deal for drivers and insurance companies alike, so it’s important you understand what happens when you reach the end of your three-year period. That way, you can quickly deal with the ongoing effects of the insurance requirements and get back to a more normal insurance cost.

Recent Comments